Investment banking is a demanding profession. Typical work weeks require far more hours than most jobs, and high stress and tight deadlines are the norm, not the exception.

Despite this, investment banking jobs can be very lucrative and rewarding. If you’re looking to take your career to the next level, writing a cover letter for a job and building a CV are necessary steps you need to take.

Your time is valuable, which is why we’ve researched the best CVs and what employers are looking for in 2026. We’ve created ten investment banking CV samples, plus a guide to making this as straightforward as possible. Check out our tips and see what skills you’ll need to secure that high-paying position.

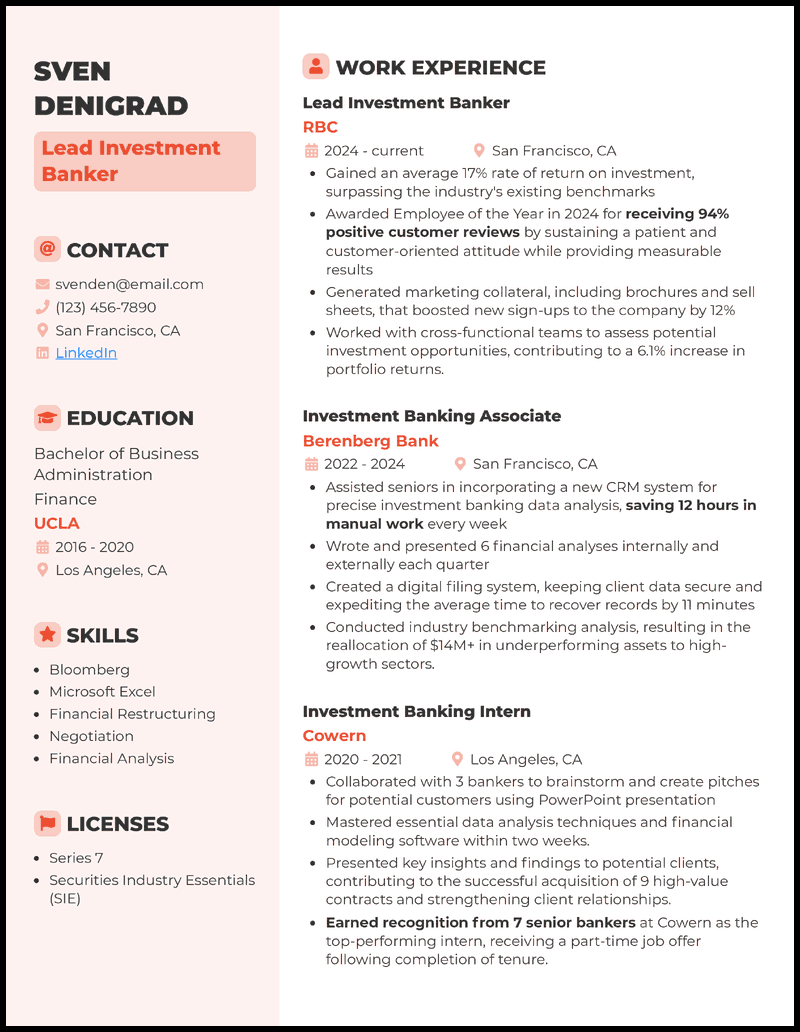

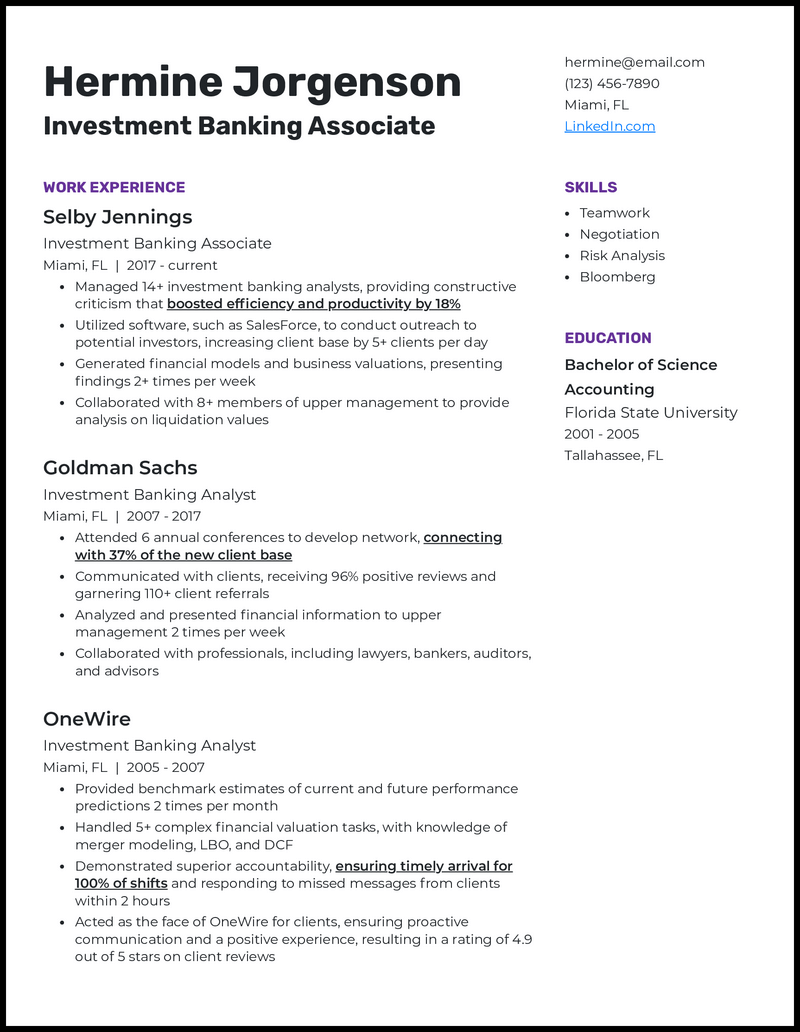

Why this CV works

- Did you know that over 300 candidates often apply for a single investment banking job advert?

- A good investment banking CV starts with a professional CV format.

- The reverse-chronological format is an excellent choice, as it places your most relevant and recent experience at the top of the page; if your information is buried, there’s little chance a busy hiring manager will have the time or inclination to search for it.

- Keep your CV concise and to the point.

- Sometimes, people tend to want to include every work experience or job they’ve had since they were 10. However, the lemonade stand you ran with your neighbour isn’t really relevant here. Limit your work experience to the most relevant and recent two to four jobs you’ve held, and ensure your CV is exactly one page long.

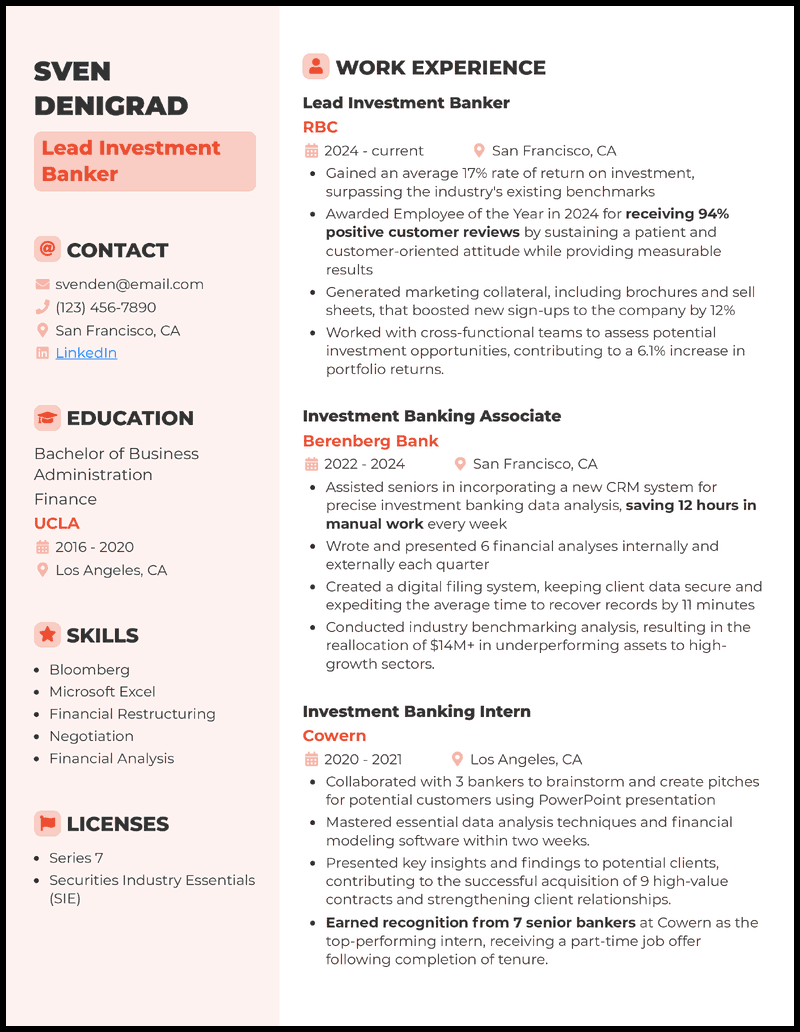

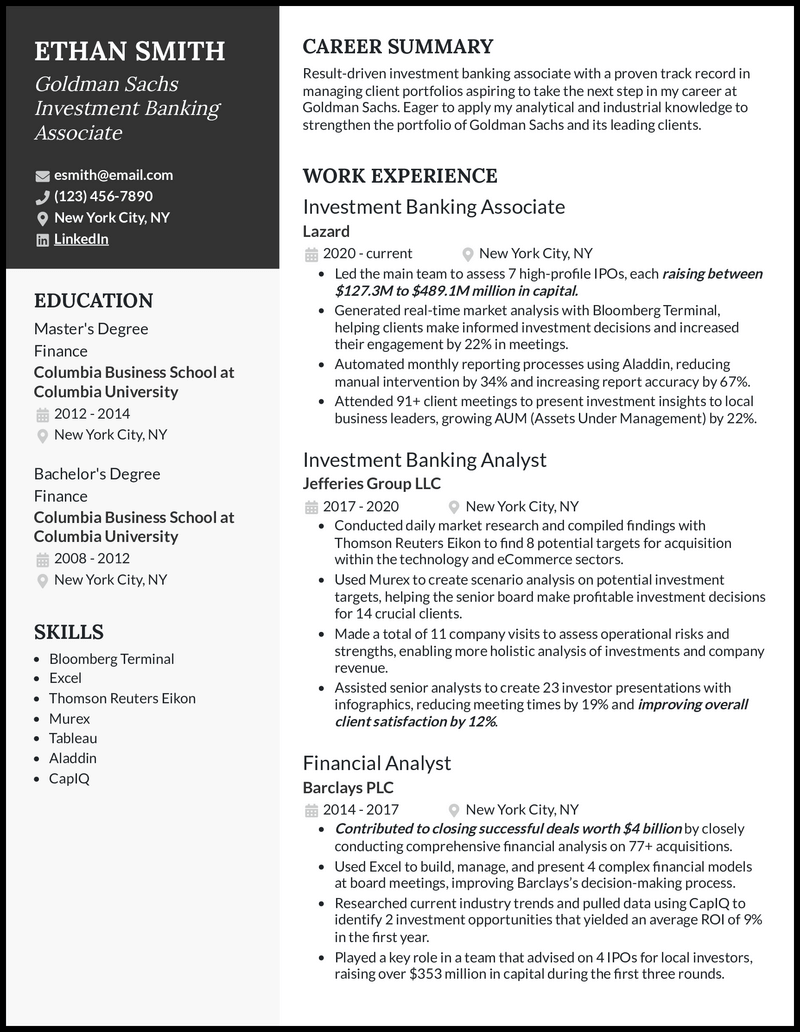

Why this CV works

- It’s important to get your investment banking analyst CV right. According to hiring managers, only 10 per cent of aspiring investment bankers with a university degree will secure a job in the field.

- Aside from achieving excellent grades and gaining relevant experience, you need a CV that will reflect those details while being visually appealing.

- If, for example, you apply to Barclays with impressive work experience, it’s a great start; but how you demonstrate your impressive work history will determine whether your CV makes the cut…or ends up in the bin.

- Ensure you include quantifiable metrics throughout your entire CV.

- Metrics are an efficient way to demonstrate your abilities, as numbers show (rather than tell) employers the results you’ve achieved.

- Examples of quantifiable metrics relevant for investment bankers include the number of clients you’ve worked with, client satisfaction ratings, your average rate of returns, how data you’ve compiled and analysed financially benefited the company, etc.

View more investment banking analyst CVs >

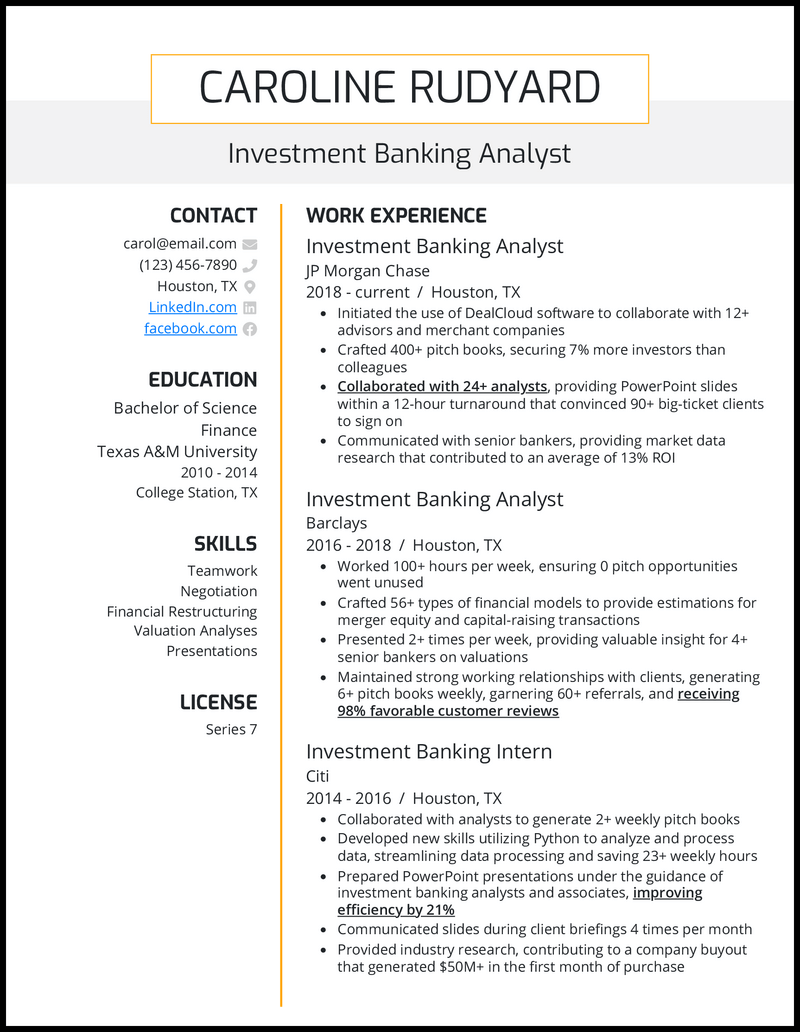

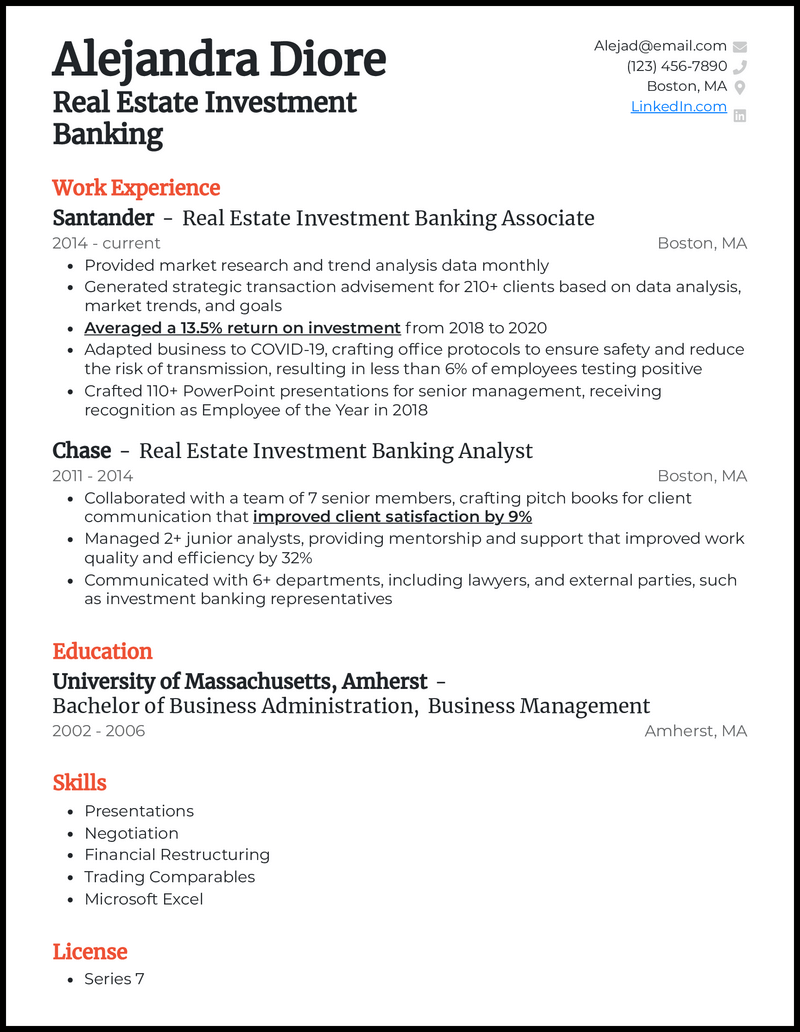

Why this CV works

- Your investment banking associate resume might be brimming with impressive work experience, but one small detail on your resume could keep hiring managers from reading it—your resume skills section.

- It’s a small part; nonetheless, a skills section is a critical part of your CV.

- That’s because investment banking jobs are incredibly competitive. It’s common for 300-400 applicants to apply for a single job posting! So, hiring managers use Applicant Tracking Systems (ATS), which filter and discard CVs that are lacking or light on keywords, to quickly eliminate applicants who may not be a good fit.

- Another way to increase your chances of securing an interview is to choose a CV template that’s both professional and stylish.

- While content is king, employers are likely to miss your content if the CV itself is dull and underwhelming.

View more investment banking associate CVs >

Why this CV works

- Now, Goldman Sachs isn’t everyone’s cup of tea. But if you’re determined enough and have a broad financial background to demonstrate, then it might be just right for you!

- Qualifications such as a master’s degree and various financial roles that demonstrate your expertise with tools like Bloomberg Terminal and Aladdin are an added advantage for your Goldman Sachs investment banking CV.

Why this CV works

- Are you one of those people who’ve always been naturally good with numbers? If so, for your investment banking intern CV, you can mention a past work experience as straightforward as a cashier!

- What would elevate this experience from straightforward to exceptional are the results you discuss in your investment banking cover letter and CV. Demonstrate to the employer why you stand out from the average candidate with any past relevant project that highlights your knowledge of how to identify market trends and analyse a firm’s potential.

Why this CV works

- Trying to sell yourself with a two or three-page CV is one way to ruin your interview chances. And failing to tailor it to the job? Now, that could be the final nail in your job hunt—recruiters hate generic pitches more than we all dread Monday mornings.

- An impressive, experienced investment banking CV must align with the job’s requirements, so it’s your responsibility to include the right keywords to ensure it does. Do all your CV sections demonstrate your suitability for the role, whether highlighting transferable skills or a relevant educational background? Yes? You’re on the right track!

Why this CV works

- If calling the shots is right up your street, recruiters are scouring the market to find you. Think of sharing your greatest professional achievements (quantified) in your investment banking vice president CV as putting up a beacon to help them single you out.

- With a phrase such as “oversaw a $452 million cross-border M&A transaction, using Eikon to assess financial market conditions and identifying cost-savings worth $18 million” in Rhys’ CV, you get the picture.

Why this CV works

- When you’re writing your real estate investment banking CV, make sure it’s flawless by double-checking your CV for thoughtful word choices, sentence structure, and formatting.

- One of the most difficult aspects of writing resumes is learning how to sell yourself. This is the time to own it!

- Avoid using language that diminishes or undervalues your experience when writing about it.

- A great place to start “owning it” is your CV summary.

- If you’ve got 10 or more years of experience in the same industry, make sure to mention it! Take the opportunity to impress employers with any specialisations you’ve developed in two to three impactful summary sentences while you’re at it.

- Unlike the CV objective, a summary is exclusive to candidates with extensive experience.

- Did you know that 80 per cent of investment banking hiring managers surveyed said they wouldn’t hire a candidate who didn’t present themselves confidently? Use action words to start each sentence and active voice to strengthen the flow.

View more real estate investment banking CVs >

Why this CV works

- You have a knack for delving deeper to learn more about market trends. Recruiters are of the same mindset, too, which makes adding the link to your LinkedIn profile to your investment banking research analyst CV an absolute must.

- A hyperlink to your LinkedIn profile is worth the space in your CV’s header. And how do you ensure that works to your advantage? Customise the profile so it presents a compelling image of an experienced and highly recommended investment banking research analyst. It’s about adding depth to your professional persona.

Why this CV works

- It’s difficult to get your foot in the door with an entry-level investment banking CV.

- When you don’t have much work experience in the field, make sure to include relevant internships, school projects, hobbies, or even voluntary work.

- If you lack work placements or volunteer work, don’t worry! Any experience can be written to highlight skills on your CV that are especially relevant to investment banking.

- For example, jobs in restaurants also involve high-pressure, high-stress work where you must work quickly as part of a team.

- We recommend including a resume career objective when you’re light on job experience.

- However, career objectives need to be made highly specific to each job you apply for!

- You’ll make an impact when you include the name of the company you’re applying to while also briefly discussing transferable skills you can bring to the role.

Related CV guides

How to Write an Investment Banking CV

To aim for a role where million-pound deals are just a regular Tuesday occurrence, your CV needs to convey that you’re the professional businesses can depend on. Let’s have a look at a few essentials that you should consider including:

Begin with the correct format

No matter how skilled you are with numbers or managing clients’ assets, it won’t mean much if you cannot get past an ATS system. Formatting your investment banking CV is the first step to improving your chances of getting hired, and we’re here to tell you all about it:

- Strong key sections: Don’t leave your skills, work experience, and education sections blank for any reason. Strong sections will help you breeze through ATS systems.

- Reverse-chronological format: List work experiences in reverse-chronological order so employers can see your most recent achievements at the top.

- Length: Your investment banking CV will work best when it’s kept to one page. Exceeding this length only benefits professionals with extensive experience and even then, it carries a level of risk.

- Bullet points: Avoid lengthy paragraphs or large blocks of text; summarise your work experience concisely using quantified bullet points.

Let Your Experiences Shine

Your work experience is a trump card—almost like a guaranteed ticket to getting hired if you do it right. First things first, quantify. Use metrics to explain each bullet point and your contribution in helping clients build strong portfolios.

Example

✅ Assisted senior colleagues in implementing a new CRM system for accurate investment banking data analysis, saving 12 hours of manual work each week.

Highlight your top skills

From calculating the profitability of volatile assets to communicating with clients promptly, your skills section should include everything that makes you the top investment banker. Here are a few things you might consider adding:

- Bloomberg

- Negotiation

- Financial Analysis

- Financial Modelling

- Asset Management

Add education and qualifications

Include your degrees in finance or business to demonstrate that you’re the ideal person for making any financial decision. Achieved a grade point average of 3.5 or above? Make sure to include it. Additionally, any finance-related qualifications, such as Chartered Financial Analyst (CFA), should be included to enhance credibility.

Key points

- Use a reverse-chronological format to highlight your most recent achievement at the top.

- A degree in finance/business and relevant qualifications prove you’re all set to hit the ground running.

- Utilise quantified bullet points to highlight your past contributions and how they benefited clients.

Investment banking CV FAQs

To write a compelling investment banking CV, tailor your experience to the job description. Does the firm need someone who can handle volatile assets? Craft quantified bullet points showcasing your knack for analysing risk and optimising portfolio performance, and mention a few financial modelling software to impress employers.

An investment banking CV should be a one-page document. If you’re an experienced professional, you might consider creating a two-page CV, but only if the extra content helps you tailor your profile to the job advert.

Yes. The right CV template ensures you use the correct format to present your strengths and qualifications. It provides the space to effectively pitch your value to the recruiter and help them quickly see why you’re a perfect fit for the role. Moreover, a professional CV template makes passing applicant tracking systems (ATS) straightforward, improving your chances of securing more interviews more quickly.

They look for tangible achievements and relevant hard and soft skills from related work experiences. They also expect you to demonstrate leadership, teamwork, and the ability to achieve results. If you lack direct experience, you should also show enthusiasm for finance or investment banking. Your aim is to align yourself with the expectations of potential employers.

Focus on your technical and client-facing skills. Use quantified bullet points to directly mention your proficiency in finance and asset management tools, such as Quantrix, Finmark, Bloomberg, and Morningstar Direct.