Bank Teller

Best for careers that encourage creativity

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

As a bank teller, you’re the first point of interaction for customers. You’re responsible for verifying customers’ identities and processing various financial requests.

Bank tellers answer product and service questions and direct customers to more senior staff for complex bank transactions.

Each level of your career, the type of institution you work at, and the financial transactions you have experience with will determine how to write your resume and make a cover letter to attract the attention of a hiring manager or recruiter for your dream job.

We analyzed countless resumes from all stages of teller careers and created nine bank teller resume samples to help you make a resume free and land more interviews in 2026.

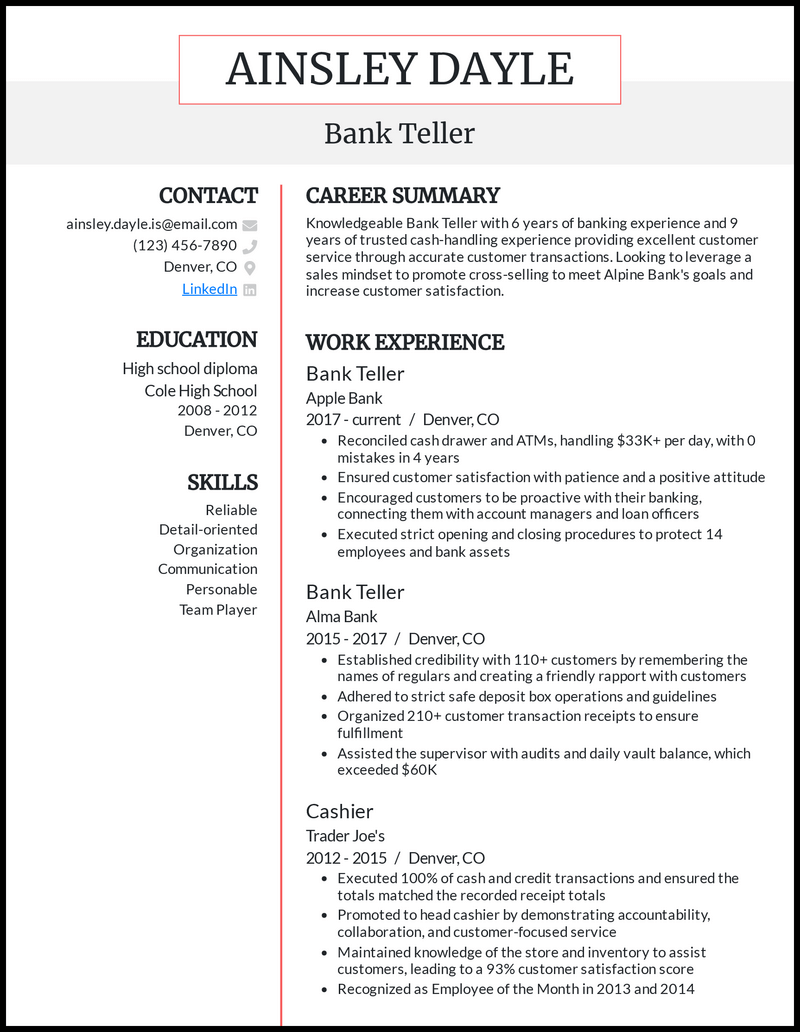

Why this resume works

- A resume summary lets potential employers view your qualifications right off the bat, saving them time and making you look more desirable.

- Be sure to draw attention to any unique skills, such as speaking another language or managing security systems.

- Adding metrics to your security guard resume may take more time, but they’re invaluable since they give potential employers a solid idea of what you can accomplish once you’re hired.

- Good security guard metrics can include how many visitors you greeted, the number of patrols you did per shift, and how much you increased efficiency with your efforts.

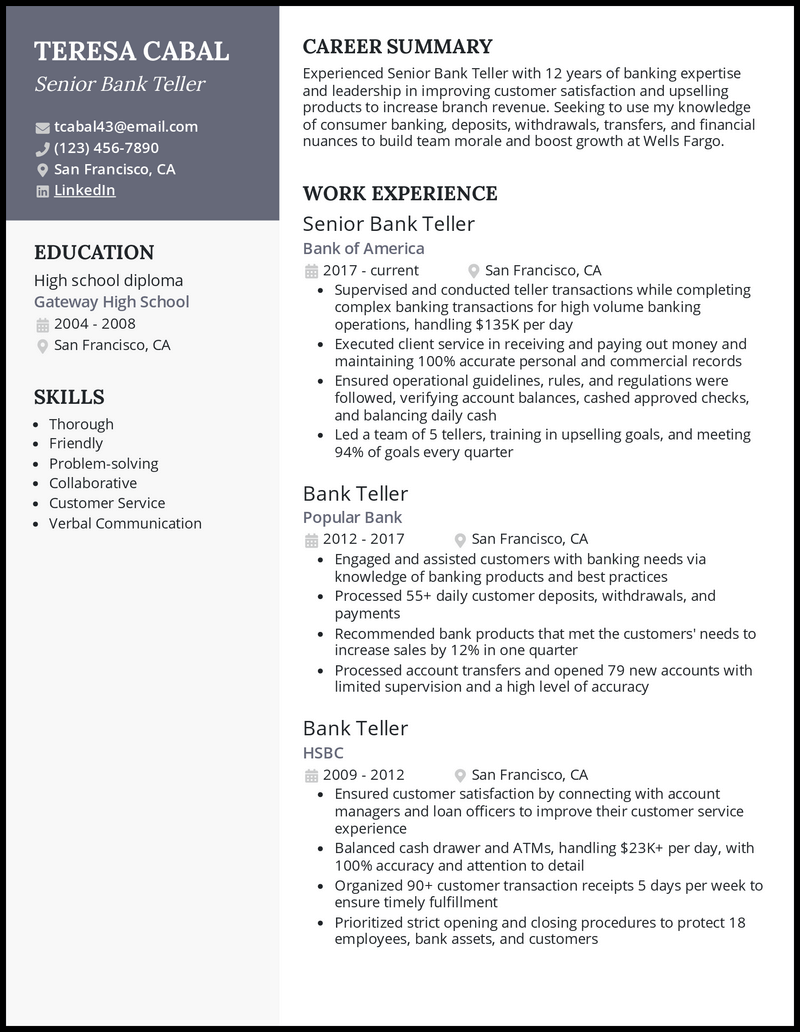

Why this resume works

- A customer service representative experience can be your fastest lane to help you grow in your banking career. Something that you should utilize to give your Wells Fargo bank teller resume an edge is your impact on customer satisfaction levels.

- For instance, mentioning how you maintained a customers’ satisfaction rate of 98% would position you ahead of other applicants.

Why this resume works

- Your impressive capability to call the shots is what makes you a match for the bank teller supervisor role, right? Highlight it in your resume, and the potential employer will have no choice but to add you to their short “Must Interview” list.

- A bank teller supervisor resume with phrases like “Supervised and trained 12 junior tellers, smoothening daily operations and account management with Temenos T24” and “prevent 56 suspicious transactions per month” could truly be your saving grace.

Why this resume works

- A senior bank teller often has experience with more complicated financial transactions and higher volume transactions. Be sure to include specific data surrounding the number of transactions and the value of those daily transactions.

- Use our resume checker to ensure your senior bank teller resume is the highest quality.

- Senior bank tellers are leaders, so including your leadership experience is important to hiring managers. They want to see that you share your knowledge, ensure the morale of your branch, and can meet or exceed your assigned branch goals.

- Focus on your ability to follow the bank’s rules and regulations. As a senior bank teller, it is important to showcase your knowledge in the financial industry and your ability to audit transactions, ensuring the bank is compliant with all laws.

See more senior bank teller resumes >

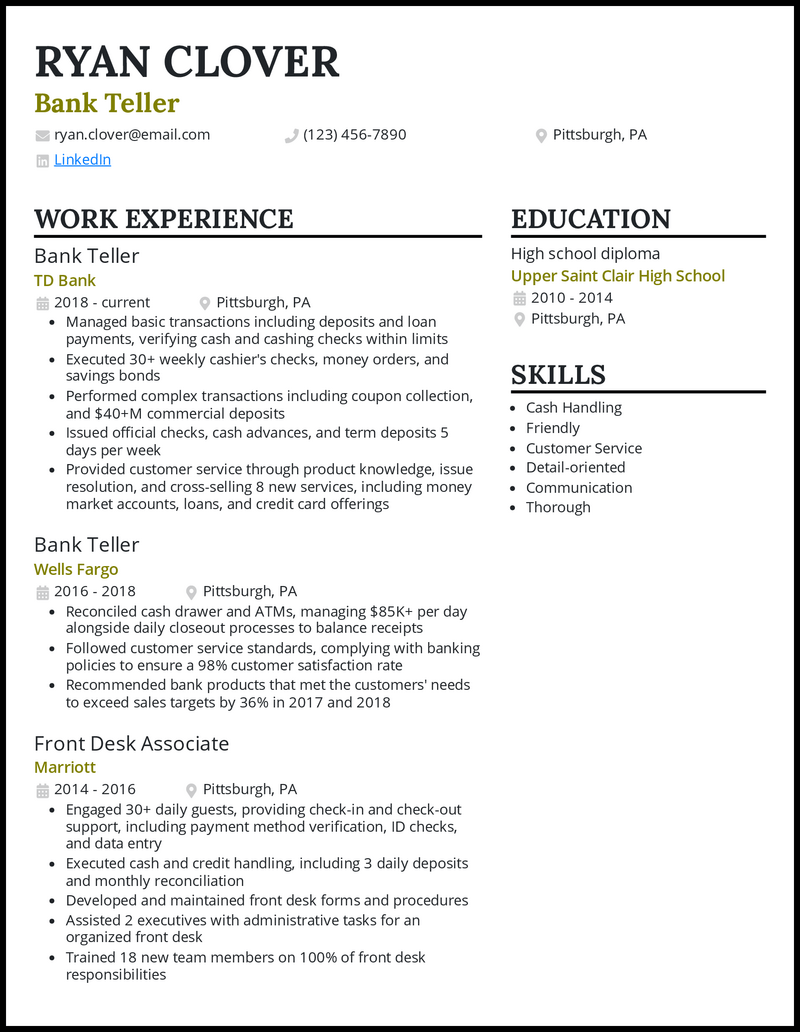

Why this resume works

- The banking industry thrives on efficiency, accuracy, and ensuring customer satisfaction. Therefore, your bank clerk resume should highlight achievements backed up with impact in these areas.

- Put numbers (hint: reduced processing errors by 26%, and reduced average waiting time by 81%, and so on) in your piece and let recruiters be impressed by what they see.

- Complement this in your bank teller cover letter by explaining the how and why of your greatest achievements.

Why this resume works

- Common knowledge has it that the recruiter only wants to see a well-written skills section on your head bank teller resume, no matter what it comprises. How about letting your opponents lean on that when you outshine them with a showcase of your relevant technical prowess?

- Throwing down a list of job-specific software you’re familiar with (think FreshBooks, NCR Counterpoint, Verafin, and Qlik Sense) is smart; think of it as your ticket to setting yourself from those flashing common (though handy) competencies like “hard worker” and “attention to detail” Now, illustrating the tools’ application in your work history goes a long way to add substance and flair to your piece.

Why this resume works

- Bank teller backgrounds can be vast; highlight any roles where money handling and customer service were a daily responsibility. Adding data behind your responsibilities is a great way to get the attention of a hiring manager or recruiter.

- Use the skills section of your TD bank teller resume to showcase your experience with specific products and tools, even banking institution types such as a credit union or commercial bank.

- If you know a financial product, stand out by highlighting this experience on your resume.

- Your resume overview needs to include your goals, target company or role, and how you are the best person for the job. Research the company you’re interested in applying to and find out what they value.

- Add your applicable skills and knowledge to ensure the hiring manager sees you are the right person for the job.

See more TD bank teller resumes >

Why this resume works

- You need to create an entry-level bank teller resume that will grab the attention of the hiring manager without having extensive experience as a bank teller. You want to identify common, transferable skills from other work experience.

- List any job where you handled money; cashier, retail, food service. The business does not have to be a bank or credit union; it can be an environment where you provided trusted money handling.

- The finance industry is vast, and if you worked for a financial entity, be sure to include this experience, highlighting any transferable skills on your resume, including financial services and product knowledge.

- Customer service is very important for a bank teller, so showcase your ability to provide exceptional customer service (in any environment). Employers will appreciate seeing the applicable skills easily, ensuring your resume catches their eye.

- Use a resume objective to tell the hiring manager how your skills can be used in the bank teller role, how you will impact the company, and be sure to mention the target company by name.

See more entry-level bank teller resumes >

Why this resume works

- As a cash management services teller, your work environment is highly professional. So, you should hold yourself to the highest degree of professionalism on your cash management services teller resume.

- Use a muted, appropriate, but thoughtfully contrasting color for your header and the smaller sections on your resume.

- Can the ATS parse your resume and understand its structure? Organize your work experience and projects with bullet points, and don’t shy away from numbers.

- Including metrics that quantify your work experience will demonstrate to hiring managers that you’re accurate and efficient with numbers, essential for the job.

- Include a hobbies/interests/activities section on your resume, especially if you have volunteer work or personal interests in the finance industry.

- This creates more applicable content for your resume, increasing your chances of an interview.

Related resume guides

How to Write a Bank Teller Resume

Summary

Master the art of crafting a standout bank teller resume that highlights your skills, quantifies your impact, and easily passes ATS checks.

So you’ve got the chops to help customers with their withdrawal and cash deposit needs and only need to translate them onto your resume? You’ve come to the right place. As much as everyone enjoys having money in their accounts, you’re the one responsible for making sure it reaches there safely.

Ready to learn what you should have on your bank teller resume to ensure your spot in the branch? Let us show you how.

Put your best banking experiences on display

Here’s a little hiring truth, you can’t impress employers by simply saying you help customers make daily deposits and withdrawals on your resume. An HR may not even know what duties you’ll be handling and might only skim your application for a few seconds.

Those few seconds are what you’re going to capitalize on. List your best past work experiences and use quantified bullet points in each one. Now, quantify doesn’t mean you just list how much cash you transact every day, but mentioning real-life impacts like:

- Reducing transaction errors

- Expediting document retrieval speed

- Maintaining a high level of accuracy

- Improving customer satisfaction rates (the classic in almost every field)

Here’s a bad example of writing a work experience bullet point:

- I was responsible for upselling premium debit cards with 5 other junior bank tellers, and met the majority of quarterly goals.

Now, here’s a good example:

- Led a team of 5 bank tellers in upselling premium debit cards, meeting 94% of all goals each quarter.

You don’t always need to mention an impact that has to do with withdrawal/deposit, but most of your resume should have some sort of transaction-based result. The point above is an example of what you can do if you’ve still got space but run out of points.

Show employers that you’ve studied banking professionally

Typically, bank teller jobs do not require a degree in finance, but if you’re trying to climb up the ranks, preference will always be given to a bachelor’s or associate’s in finance. Certifications work similarly, too.

The way you present this information also matters. Only include your most recent and highest education qualification in the format given below:

Coming over to certifications, you can include any of the ones (or similar) mentioned below:

- ABA Bank Teller Certificate (American Bankers Association)

- Teller Specialist Certificate (Independent Community Bankers of America)

Just like your education section, make sure your certifications are lined up neatly in a separate section. For example:

Certifications

Professional Teller Certification – 2026

Certified Community Banker – 2023

Certified Payments Professional – 2021

Your banking skills have to make an impact

For the most part, you only need to be quick, have good mathematical knowledge, and know how to use banking software to succeed in this role. But, the best advice we can really give is visiting the job description.

Check out skills that matter to your future bank branch the most. Is it maintaining a positive demeanor in front of customers? Being accurate? Or maybe even multitasking? Pick out keywords and update your resume accordingly.

To get you started, here are some common bank teller skills, separated by categories:

Accounting Software:

- Fiserv DNA

- QuickBooks

- Xero

- FreshBooks

- Sage 50cloud

- NetSuite

Cash Machines:

- Jumio

- Glory Currency Counters

- Assida

Soft Skills:

- Communication

- Bilingual (Spanish)

- Patience

- Problem-solving

- Customer Service

Format your bank teller resume right

Before making it to an employer’s desktop, your resume will have to go through a relentless ATS system that can easily cut you out of the competition for the slightest formatting error. The good news is we’re here to tell you what exactly you need to focus on:

- Enrich the essential sections: A strong skill set, work experience, and education that includes keywords from the job description are your biggest ticket to getting hired, so make sure you read the job listing carefully and pick the most important terms.

- Resume format: A reverse-chronological resume format will help you display your most recent achievements at the top, giving you that extra bit of leverage during both ATS and employer reviews.

- Avoid going overboard with bullet points: Trust us, you only need 3–4 bullet points for each work experience. Having any more can turn your overall design dying for some white space.

Top 5 tips for your bank teller resume

- Always be ATS-friendly: The best way to beat the strict resume scanners is by using a reverse-chronological resume format. Simply list your recent experiences at the top and include older ones as you go backward. Also, don’t forget to include keywords mentioned in the job description.

- Have a strong skills and work experience section: This is one of those jobs where education won’t matter as much as your experiences. Having a degree is a plus but not mandatory, so if you don’t have one, simply add your diploma and focus more on refining your skills and work experience bullet points.

- Check, double check your resume: You’re a bank teller that’s trusted for accuracy. The last thing you need is being caught making typos so proofread and check your resume once before you send it to any employer.

- Be concise with your bullet points: Even if there’s a lot you want to say, your work experiences should only include relevant information. Write about what you did, the skills you used, and the impact it had on banks previously.

- Use action words at your disposal: Using personal pronouns on resumes is a thing of the past. To begin each sentence, use a verb that is contextual and reflects your bank teller skills. Some examples include Reconciled, Helped, Processed, Facilitated, Dispensed, and Verified.

Bank Teller Resume FAQs

To make your bank teller sound good on a resume, focus on formatting your resume and include a versatile skill set that shows your expertise in handling transactions and communicating with customers.

While describing your bank teller work experiences, quantify each work experience bullet point and mention impacts that benefit customers and banks. From reducing transactional errors to shortening wait times, have a unique impact for each point to set yourself apart from the average candidate.

If you’re a fresher applying for an entry-level position, try using the objective below as an example:

“Motivated finance professional seeking an entry-level bank position to apply accounting skills and passion for helping customers. Ready to improve your bank’s customer satisfaction while honing my bank teller skills.”

![9 Bank Teller Resume Examples [& Templates]](https://beamjobs.wpenginepowered.com/wp-content/uploads/2023/02/bank-teller-resume-example-1.png)