Banking

Best for professionals eager to make a mark

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

Whether you’re an entry-level bank teller or you’ve climbed the ladder to being a manager, working in banking requires that you know your stuff. Thanks to your in-depth knowledge of the financial landscape, interpersonal skills, and keen eye for numbers, your bank’s customers walk away happy after each visit.

With various legal regulations, keeping up to date with the latest banking software, and studying new products, you’ve got your hands full on a daily basis. However, you’ll need to find the time to create an effective resume to advance your career.

That’s where we come in. Our AI cover letter generator, banking resume examples and handy resume tips helped hundreds of banking professionals land their next jobs, and now, it’s your turn!

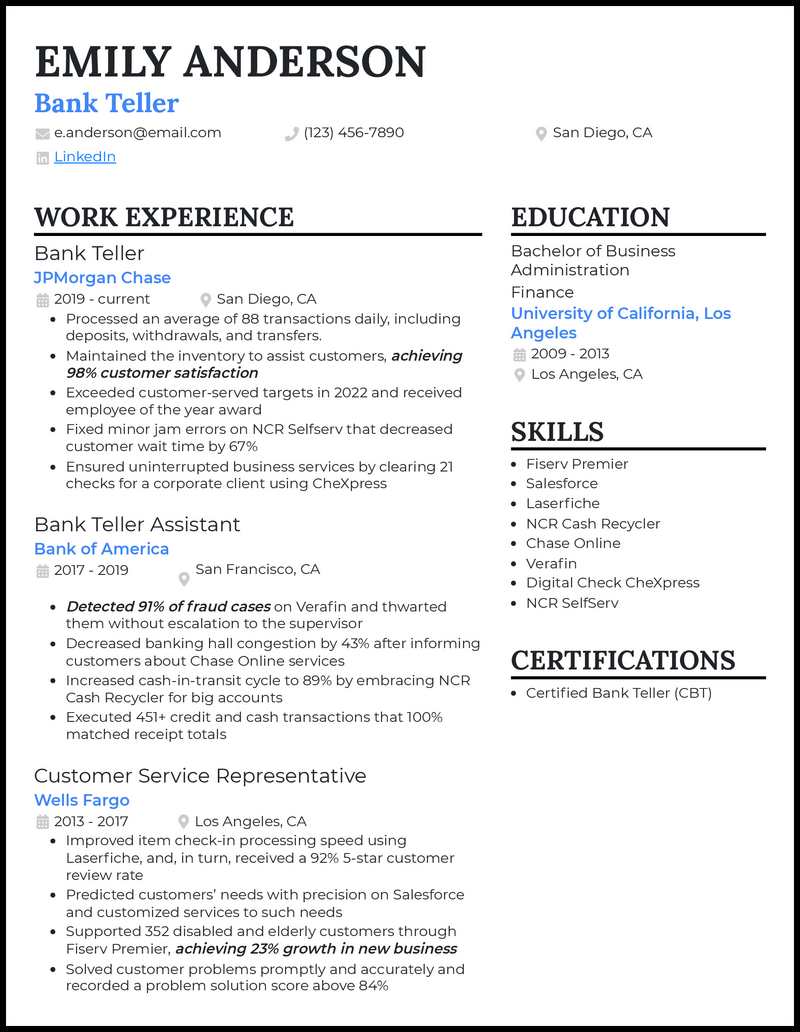

Why this resume works

- You must find a way to draw the attention of hiring managers without having comprehensive banking experience. Identify and highlight unique skills that show your bank teller competencies.

- Show your workplace impact in your banking resume by detailing your numbers in driving customer satisfaction, solving problems, and cutting down process time to optimize profits.

Why this resume works

- Your achievements, quantified for that matter, will be like an effective signage that draws attention to your experienced banker resume. After all, you ought to show what makes you an expert in what you do.

- On top of your achievements, including a certification such as a Certified Bank Teller further lends credibility to your application and gets you closer to the door.

Why this resume works

- The room with candidates salivating over that plush associate banker job brimming with perks can be likened to a can too tight with sardines. You don’t have a shot if the recruiter thinks you’re just another Joe Schmo. That’s exactly why strutting your job-relevant credentials isn’t just smart—it’s critical.

- Your Certified Wealth Strategist (CWS) or Commercial Banking & Credit Analyst (CBCA) certification, for instance, can give your associate banker resume a much-needed facelift. It signals to recruiters that you meet industry benchmarks and are willing to go the extra mile to strengthen your skill set and propel your career forward.

Why this resume works

- Demonstrate your work history, advancing from banking associate to risk analyst at reputable institutions, to highlight your steady career growth and reliability.

- Quantify your accomplishments, specifying deal size, revenue growth, or portfolio performance to prove your leadership in significant projects.

Why this resume works

- You’re not looking for an opportunity to be a mere employee; you’re stepping into a decision-making role that demands leadership and management skills. Therefore, you should demonstrate unrivalled competencies in your bank branch manager resume to edge other applicants.

- To do this, display how you’ve streamlined processes, led teams, and boosted customer satisfaction. Now is great time to introduce metrics such as cutting administrative overhead, spearheading staff training, and more.

Why this resume works

- Employers are looking for specific personal banker skills to gauge your suitability for the role. Therefore, matching your skill set to the job requirements will get you noticed.

- Integrate your measurable achievements such as meeting sales quotas, solving customer problems, driving up profits, and so on in your personal banker resume.

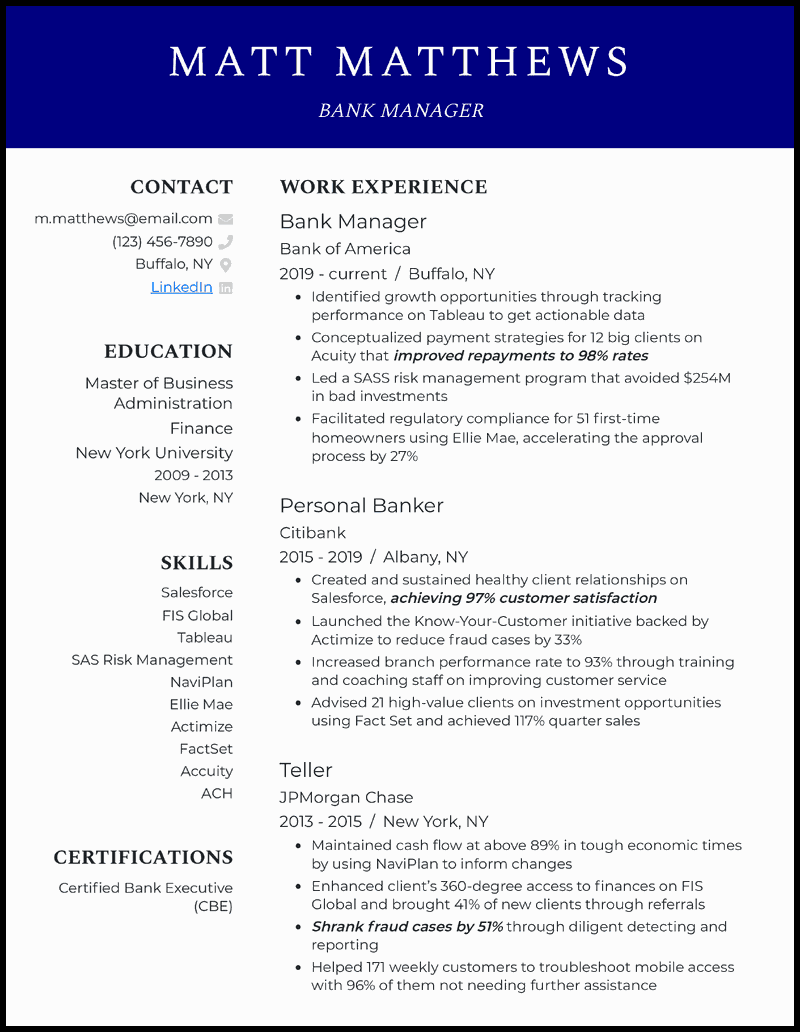

Why this resume works

- You’re expected to vividly show your achievements in past/current roles. Avoid the temptation of listing what the job expected of you but rather highlight what you achieved.

- Impress potential employers by showing your sales performance, customer service, and business growth metrics in your bank manager resume.

Why this resume works

- Do you really need a killer relationship banker resume when your clients and former employers can swear by you? Yeap, you do, and the best way to compose it is by throwing in genuine digits to call attention to moments you came through for those former places of work.

- We suggest injecting some life into your work history with quantified accomplishments. Take “…ensuring 100% compliance with JPMorgan’s regulatory standards while processing $2.7 million in assets over six months” and “…preventing over $$99K in load default losses,” for instance. Now, that’s how you turn a good narration into a wow moment for hiring managers.

Why this resume works

- Seeing that your days are spent engaging with customers and putting out work fires left and right, it’d be smart to flaunt those remarkable problem-solving skills in your universal banker resume. It’s all about letting potential employers know you’re a safe pair of hands they need on their team.

- Get down to specifics like how you turned detective with Experian Fraud Detection tools, screening transaction data, and customer behavior, thus preventing six fraud attempts in a month. Or how you advocated the integration of DocuSign for account opening procedures, which not only trimmed document turnaround time (by maybe two days) but also boosted client satisfaction. That’s gold!

Why this resume works

- Let’s be honest: your future employer isn’t exactly looking to play tutor, especially regarding the nitty-gritty of building client relationships. Your move? Let them know you’ve been in the game for a while and can handle things without needing a crash course from them.

- Calling attention to at least one experience in a work setting similar to that you’re vying to join can do the trick for your business banker resume. And don’t rattle off your duties to give recruiters a taste of your potential; do them one better by serving up your proudest accomplishments complemented by genuine metrics.

Why this resume works

- Yes, satiating the diverse needs of high-net-worth individuals is your cup of tea. But recruiters don’t have to book an appointment to contact you as they might with those high-flyers, right? Adding your contact information to your private banker resume is etched in stone.

- Your updated contact deets (think phone number and professional email address) should sit at the top, regardless of the resume template you go with. And right after that, it’s smart to hyperlink to your LinkedIn profile, inviting hiring managers to dig deeper into your professional world.

Why this resume works

- Thanks to technological advancements, the mortgage industry is like shifting sands. A resume highlighting your proficiency in role-relevant software sends a clear message: you’re quick on the uptake. That marks you as a prime hire in an industry where agility is key to catching the next big shift.

- So, why not let software like Calyx Point, Salesforce, Dropbox Business, ComplianceEase, and LoanSifter steal the show in the skills part of your mortgage banker resume? Spice things up a bit, though—your work history section should illustrate how you’ve milked the tools dry to squeeze out impressive results at various companies.

Why this resume works

- You’re good with numbers and have what it takes to help clients smash their financial goals. Awesome! Ensure your fortes get the glory they deserve by bolding and italicizing (or underlining) your most remarkable achievements on your retail banker resume.

- You see statements such as “Processed $2.3M in in-person and online card payments through Worldpay” and “…spearheading a new membership growth initiative that attracted 854 new customers over six months?” That will catch the recruiter’s eye and showcase your value straight away. Keep the accentuation to the right amount, though—a single phrase per job listing will do.

Why this resume works

- We’re not saying your commercial banker resume must be the epitome of beauty, a la Helen of Troy. But an aesthetically pleasing format? That can go a long way in stealing the spotlight and if nothing else, secure you a job interview.

- Nailing the look of your commercial banker resume comes down to a few key elements: white space, a legible, consistent font, and well-defined sections. A splash of color doesn’t hurt either. So, feel free to give your header, names of former places of work, and sidebar sections a pop with something vibrant like burnt orange.

Why this resume works

- Getting on the good side of hiring managers seems to have its handbook. One surefire strategy? Make sure your corporate banker resume spotlights your higher education directly linked to the job. That move speaks volumes.

- Let’s say you have a bachelor’s degree in finance. Mentioning it boosts professionalism and credibility, plus signals you have the chops for this job. Now, if you’ve pursued a Master’s in something related, that’s even cooler. Let it take the lead in your education credentials, with your bachelor’s degree sitting proudly after that—reverse chronological order, remember.

Related resume examples

How to Create a Banking Resume that Matches the Job Description Perfectly

The key to crafting an irresistible application is to match the job description as closely as you can.

For instance, if you’re applying for a senior bank teller role, include a good mix of skills that point to your banking proficiency as well as a couple of your interpersonal abilities. That includes things like conflict resolution and cross-selling, but also knowledge of anti-fraudulent measures and Oracle Flexcube.

In any case, try to check some of the most important boxes in the job listing. Keep things specific—instead of a vague “team player,” use more descriptive skills like “relationship building.”

Want some inspiration?

15 popular banking skills

- Fiserv Signature

- Loan Processing

- Banking Regulations

- Hubspot

- Credit Analysis

- Oracle Flexcube

- Microsoft Dynamics

- Fraud Detection

- Basic Accounting

- Customer Service

- Salesforce

- Sales Strategies

- FIS Horizon

- Crisis Management

- Temenos T24 Transact

Your banking work experience bullet points

You’re no stranger to various kinds of data, be it financial figures or customer satisfaction metrics. Data will be your best friend as you work on this part of your resume and discuss your greatest achievements.

Refrain from simply listing off every single task from your past jobs—instead, frame your work as accomplishments and back it up with metrics.

In banking, money speaks volumes. Talk about the types of client accounts you’ve handled, investments you’ve guided, or branch budgets you’ve handled. There are many equally useful metrics, from reducing customer complaints to lowering the average wait times at your branch.

- Discuss your success in driving profits for the bank and its clients with financial metrics, such as revenue growth, ROI, and cost-to-income ratio.

- Mention any increases in efficiency, such as the branch performance rate, directing customers to other channels to free up more tellers, or optimizing client documentation.

- Take a customer-centric approach and talk about customer satisfaction ratings, retention, and engagement.

- Sales play a big part in banking, so show off metrics related to cross-selling, up-selling, handling loans, credit cards, and investments.

See what we mean?

- Fixed minor jam errors on NCR Selfserv that decreased customer wait time by 67%

- Detected 91% of fraud cases on Verafin and thwarted them without escalation to the supervisor

- Built 101 long-term client relationships, exceeding annual sales quota by 117%

- Conceptualized payment strategies for 12 big clients on Acuity that improved repayments to 98% rates

9 active verbs to start your banking work experience bullet points

- Led

- Identified

- Facilitated

- Launched

- Managed

- Maintained

- Improved

- Advised

- Processed

3 tips for writing a banking resume if you’re starting your career

- Lean into transferable skills

- You may be new to banking, but as long as you have any experience in working with customers, you’ve got a lot to talk about. Highlight past jobs where you worked with people, such as retail or tech support, but also college projects and internships.

- Never send out the same resume twice

- Banking requires a great deal of attention to detail, so don’t make the mistake of sending out a resume that’s tailored to a different job. Take the time to read the job description and update your work experience and skills accordingly.

- Buff up your resume with extra credentials

- Pick a resume template that lets you add courses or certifications and include them to increase your credibility. The Certified Bank Teller (CBT) certification is great, but so is the Anti-Money Laundering (AML).

3 tips for writing a banking resume for a seasoned financial expert

- Emphasize your leadership

- As you advance in your career, leadership becomes a key skill, whether it is training new colleagues or managing an entire branch. Provide examples of times when you were in charge, such as assigning tasks or handling performance appraisals.

- Spotlight your financial knowledge

- Don’t be afraid to flaunt your financial acumen by talking about your ability to manage budgets, control costs, or drive growth. For instance, discuss the kinds of budgets you managed for your branch or for particular business accounts, making sure to mention ROI to showcase your impact.

- Talk about customer successes

- A successful banker is one who leaves a trail of happy customers behind. Underscore this in your resume by including metrics like customer retention, cross-selling, or satisfaction ratings, as well as mentioning how you helped your staff stick to bank policies.

Banking Resume FAQs

Unless your career spans over 10 years, we recommend sticking to a one-page resume. Much the way customers only skim the contracts they sometimes sign, recruiters only spend a few seconds scanning your resume, so it’s best to keep it short and sweet.

A resume summary or objective can be an effective way to quickly highlight a career-defining achievement or describe why you’re the right fit for this particular banking job. Use it to mention a couple of key skills, such as your risk management, and include the name of the company you’re applying to.

You can, but it’s better to show them through your work experience bullet points. If you do add some, make them relevant to the job—for instance, employee engagement for a bank manager position.