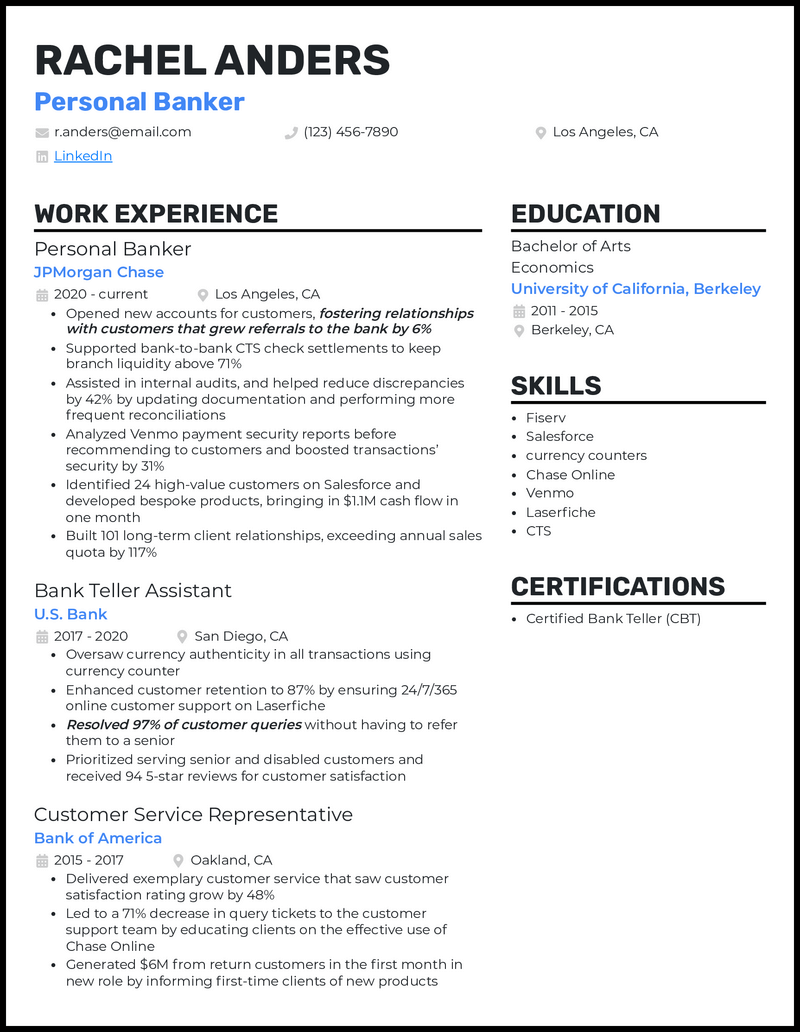

We all can use some financial or banking advice from time to time. That’s why pros like you are needed to analyze financial needs, assist when opening accounts, and review loan requests.

Is your resume set up for success to show you fit each bank’s needs? Or do you need help writing a great cover letter?

Since you play a significant role in the customer experience, banks will want to ensure you have the right financial skills to meet their specific requirements. We’ll help you optimize for success with our personal banker resume examples to provide the ideal resume templates with which to display your abilities.

Related resume examples

What Matters Most: Your Personal Banker Skills & Work Experience

Every bank operates a bit differently and has varying needs. That means you must list a custom set of job skills for each personal banking job you apply to.

The job description will help you do that successfully. It’ll tell you exactly what skills each bank is seeking, so whether they’re applying for a mortgage loan specialist or someone who’s an expert in trusts and bonds, you’ll be able to stand out.

Here are some of the most popular personal banker skills to get you started.

9 most popular personal banker skills

- Loan Applications

- Customer Relations

- Cross-Selling

- Trusts and Bonds

- Fiserv

- CTS

- Portfolio Assessment

- Market Analysis

- Strategic Planning

Sample personal banker work experience bullet points

Whether the bank focuses on customer satisfaction or generating new checking or savings account signups, the results you achieve on the job matter.

The best way to show how you’ll succeed is with bullet points of actionable achievements from your work experience. These should be based on numbers banks care about the most, such as cost savings or documentation accuracy.

It’s also essential to use the right words to make an impact. Action verbs like “approved” or “reviewed” will help with that, such as when you approved 87 loan requests and performed detailed credit checks that led to 90% repayment rates.

Here are a few samples:

- Led and promoted a new referral program to customers, boosting checking account signups due to word of mouth by 35%.

- Performed monthly reconciliations and reviews of documentation to reduce account discrepancies by 29%.

- Reviewed client investment portfolios and recommended trusts and bonds that boosted investment returns by 47% and customer satisfaction by 52%.

- Promoted the benefits of signing up for savings accounts to current customers to increase monthly revenue from cross-selling by 26%.

Top 5 Tips for Your Personal Banker Resume

- Start with a resume outline

- A resume outline is like keeping a consistent structure during account reconciliation to ensure accuracy and the best results. It’ll help you present a professional overview of relevant customer service and strategic planning skills for each job you apply to.

- One-sentence examples work best

- While a lot goes into aspects like portfolio assessment, hiring managers don’t need all the details to know you have the right abilities. One sentence saying you analyzed client portfolios and recommended investment opportunities that boosted returns by 25% goes a long way.

- Include a mix of technical and interpersonal abilities

- Personal bankers must be both customer-focused and possess technical financial knowledge. Therefore, you should include a mixture of skills such as client relations and using Fiserv.

- Proofread thoroughly

- Accuracy is a big deal for personal bankers when your analysis can significantly impact clients’ investments and the bank’s success. You can show your detail-oriented abilities immediately by proofreading to ensure you submit an accurate and grammatically correct resume.

- Keep it on a single page

- A one-page resume is the appropriate length for personal bankers. Keep all the details you include brief and relevant to each bank’s needs, such as emphasizing your abilities in loan applications and processing for a bank that needs assistance with mortgage loans.

Reverse chronological formatting will work best. As you’ve grown your career, your strategic planning and market analysis abilities will have improved quite a bit, so listing your most recent experiences first is a great idea.

You should limit your personal banking resume to three or four jobs. Ensure the ones you list are the most recent and use a relevant skill set, such as cross-selling and customer service for banks that want to boost client retention and account signups.

A resume objective works well when you don’t have much personal banking experience. It could include a few sentences about how you’re a motivated professional ready to use your experience as a retail sales associate and economics degree to ensure an outstanding client experience that leads to more sales.