You effortlessly navigate the complex world of underwriting, ensuring your organization is compliant with the evolving regulatory landscape every step of the way.

Assessing client risk, negotiating contracts, and calculating premiums are things that are now second nature to you. However, you’ll need to tap into a different set of skills to create a resume that summarizes your strengths.

Good news—we’ve helped many underwriters like you score their dream jobs! Using our sample underwriter resume examples, resume tips, and free cover letter builder, you can land more interviews and, ultimately, the job you desire.

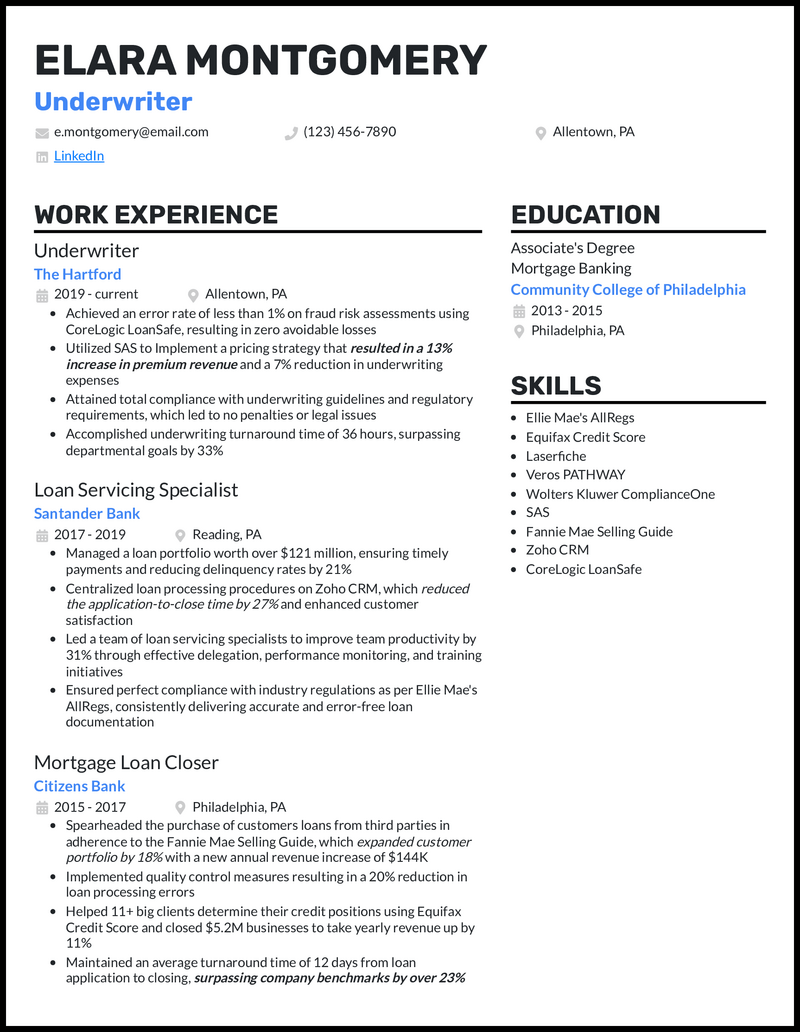

Why this resume works

- Recruiters will be interested in the statistics that qualify your impact on the overall performance of the business. One thing they’ll have a vested interest in is your ability to effectively manage large loan portfolios while sustaining growth.

- Including your role in managing a $121M loan portfolio in your underwriter resume is adequate evidence to attest to your abilities to perform at the highest levels and deliver desirable results.

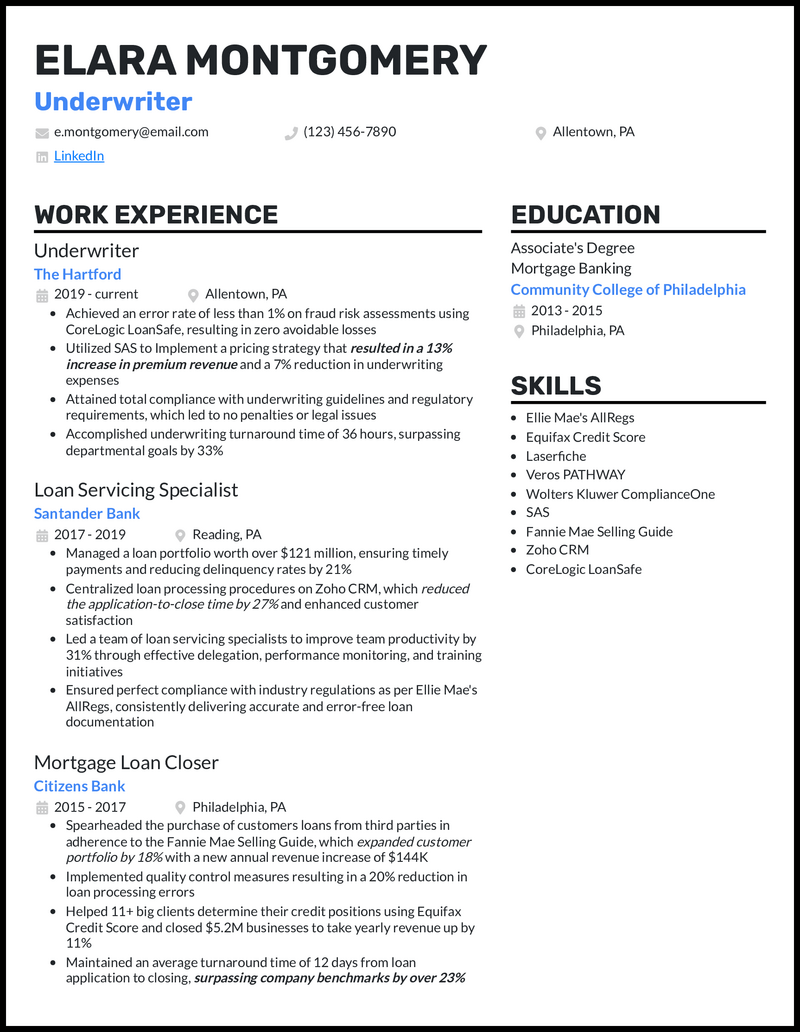

Why this resume works

- With no direct experience to write about in your entry level underwriter resume, the best way to impress potential employers is to show that you’re a documentation expert.

- Leverage your past work experiences and mention how you’ve used tools such as Pipedrive, eFileCabinet, and your negotiation skills to identify customer trends, analyze financial reports, and manage databases. Have any risk navigator projects up your sleeve? Add them too.

Why this resume works

- You want that job and there’s no two ways about it. But here’s a potential problem — your underwriter assistant resume could be so outdated that it makes defaults look like trivial problems. Time for a serious makeover, don’t you think? Begin by throwing any unnecessary components out the window.

- You see sections like the header, Skills, Work Experience, Contact, and Education? These can’t be skipped. Now unless requested otherwise by the job description, go ahead and ditch the References section—including it might make you look a little out of touch.

Why this resume works

- Securing that credit underwriter gig at your dream bank could be a turning point in your career. But first things first—you must have your resume polished to perfection; otherwise, you might give off the impression that you’re not all that meticulous about details.

- Make the most of a grammar checker to do away and to catch any sneaky typos, punctuation errors, or awkward phrases. A pro tip is to give your credit underwriter resume some breathing room. Step back for a bit, then come back to review it with fresh eyes. You’ll want it to read as smoothly as the next chart-topping novel.

Why this resume works

- When you create your commercial underwriter resume, make sure that you have your education qualification in finance.

- It’s also a great addition to having any majors or specialization in insurance and risk management. This will prove that you’re flexible and can help prevent and minimize risk as much as possible to ensure a company makes the best financial decisions at all times for its customers.

Why this resume works

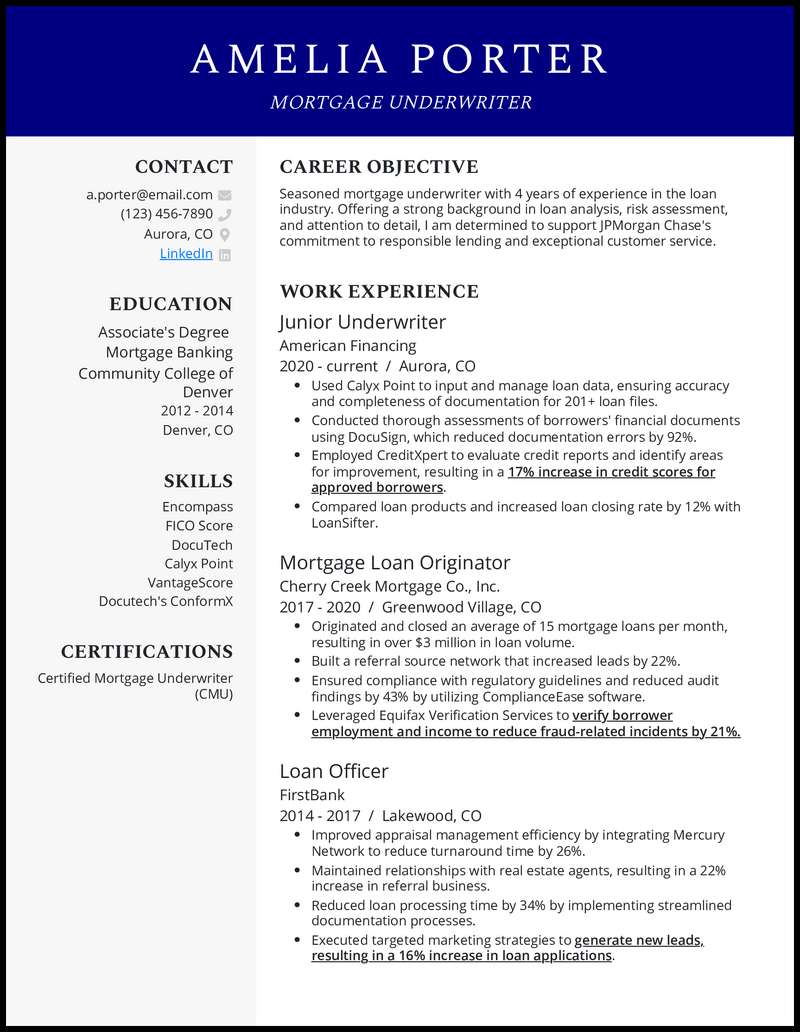

- The underwriting niche is a fast-paced space that takes bold moves, at times with massive risks, to complete big-money deals. Your critical analysis skills and familiarity with the mortgage terrain will help you make better decisions with favorable outcomes.

- Therefore, your mortgage underwriter resume should show a track record of closed deals through established and trusted networks built over the years if you’re to make a great impression on hiring managers.

Why this resume works

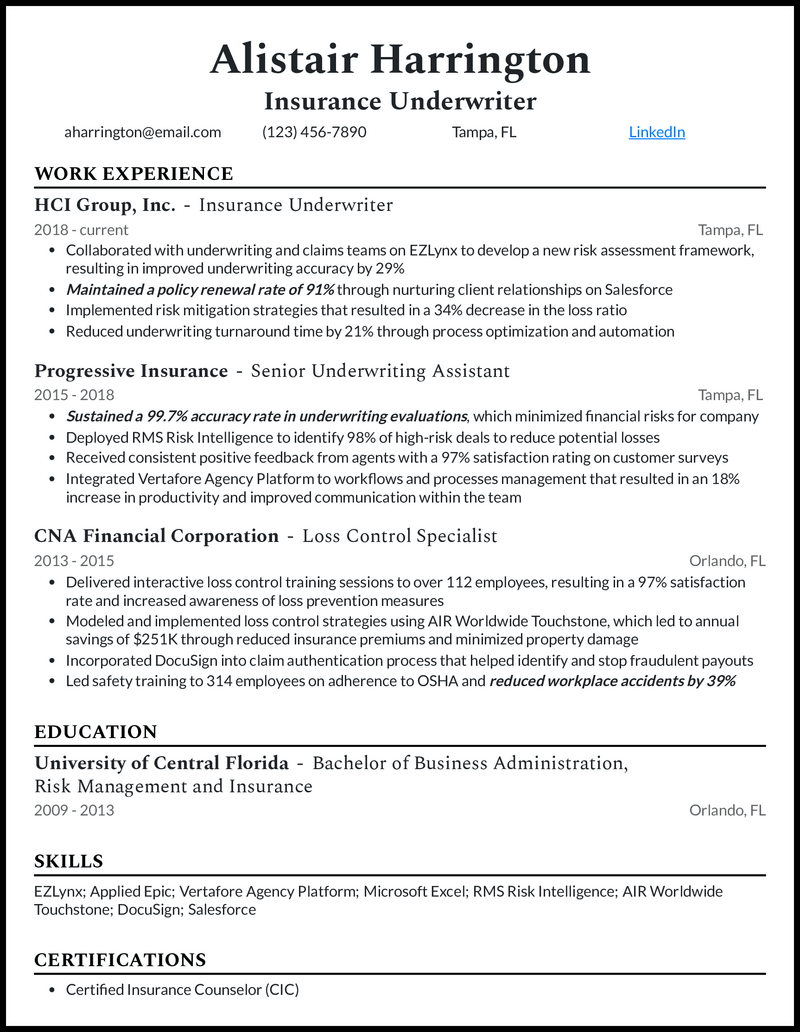

- Insurance is a customer-driven business, and the more you have in your portfolio, the more financial power you have to sustain profitability in the long haul. In essence, the customer is the king, and if you have kept them happy, then every underwriting company would want you on their team.

- Therefore, achieving a 97% customer satisfaction score in your insurance underwriter resume, among other measurable achievements, gives you a niche-specific advantage.

Related resume examples

Fine-tune Your Underwriter Resume to Match the Job

Your work drives companies’ financial decisions when it comes to issuing loans, mortgages, or insurance policies. Lean into your skills and knowledge that guide your process and allow you to make these judgments, avoiding generic terms like “teamwork” or “meticulous.”

Given the analytical nature of underwriting, it’s best to focus primarily on your technical and job-specific skills. Talk about things like regulatory compliance and financial analysis, and don’t forget to mention your software proficiencies, such as underwriting tools, risk management software, or database management systems.

Need some ideas?

15 popular underwriter skills

- Risk Assessment

- Financial Analysis

- Regulatory Compliance

- Database Management

- Microsoft Excel

- UnderRight

- Stingray

- Encompass

- RMS Risk Intelligence

- Oracle Database

- SAS

- Calyx Point

- Guidewire

- RiskMaster

- Salesforce

Your underwriter work experience bullet points

No matter the type of underwriting you specialize in, you spend your days analyzing client data, conducting risk assessments, collaborating with brokers and agents, and making decisions on policy issuance. As these tasks are known to recruiters, you’ll make more of an impression if you focus on your achievements instead.

Your work impacts your organization’s bottom line; hence it can be neatly quantified. Use this to your advantage. Show off your effectiveness and the impact you could have on a potential employer by providing concrete metrics.

Whether your strongest achievements are bulletproofing a risk assessment framework, or managing record monthly volumes of loans, this section is where you talk about them, substantiating them with data to convey your unique professional value.

- Highlight instances where your work refining and automating workflows led to reducing underwriting turnaround times.

- Show off improvements to loss ratios that your risk assessment and mitigation strategies resulted in.

- Emphasize the specific software you leveraged to achieve your goals, such as the reduction in claim rates your analysis with Excel and Tableau brought on.

- List instances where your work directly bolstered company financials, such as spearheading an increase in insurance premiums or trimming expenses.

See what we mean?

- Implemented risk mitigation strategies that resulted in a 34% decrease in the loss ratio

- Employed CreditXpert to evaluate credit reports and identify areas for improvement, resulting in a 17% increase in credit scores for approved borrowers

- Achieved an error rate of less than 1% on fraud risk assessments using CoreLogic LoanSafe, resulting in zero avoidable losses

- Utilized SAS to implement a pricing strategy that resulted in a 13% increase in premium revenue and a 7% reduction in underwriting expenses

9 active verbs to start your underwriter work experience bullet points

- Implemented

- Maintained

- Leveraged

- Negotiated

- Analyzed

- Achieved

- Managed

- Utilized

- Reduced

3 Tips for Writing an Underwriter Resume if You’re Just Starting Out

- Draw attention to your certifications

- If you have certifications such as the Chartered Property Casualty Underwriter (CPCU), Associate in Commercial Underwriting (ACU), or specialized certifications such as Certified Mortgage Underwriter (NAMU-CMU), display them prominently in your resume. They may not always be required, but they do showcase your commitment to the role.

- Match the job description

- Be selective with which skills you list in your resume, prioritizing those you feel confident in and that each job description emphasizes. For instance, if a role highlights the need for UnderRight proficiency, and it’s something you know you’re good at, then display it at the top of your skills list.

- Include your academic achievements

- If you’re applying for your first job as an underwriter, leverage your academic and extracurricular experiences to highlight your skills. For example, reaffirm your catastrophe modeling skills by talking about the college case study you undertook using Applied Epic to forecast potential losses.

3 Tips for Writing an Underwriter Resume if You’re Already Experienced

- Underscore your financial track record

- With your experience, your work has positively impacted the financials of companies you’ve worked for. Get into the specifics of initiatives you led that affected revenues, such as the fraud detection overhaul you instituted, which led to reduced losses due to fraud.

- Show your ability to collaborate

- Instead of listing “collaboration” or “stakeholder management” in your resume skills, show recruiters that it’s in your repertoire. Talk about instances where you liaised with brokers, loan originators, or policyholders, and the impact your collaboration had.

- Dive into your financial specialization

- Go into detail about your specialty within underwriting. For instance, if you specialize in insurance or mortgage underwriting, talk about specific certifications, courses, or work experience you have that contribute to your expertise.

Pinpoint some of your transferable skills from your other financial roles, such as your ability to work with Microsoft Excel or database management systems—and more generally, your flair for interpreting vast sums of data.

If you do include one, be sure to tailor it to each job description, mentioning the company and role specifically. Include your career highlights and key strengths, such as risk assessment or financial analysis.

Lender policies and federal regulations are constantly evolving. If you’ve taken steps to stay abreast of industry developments, such as attending industry workshops or conferences, mention these to show recruiters your commitment to underwriting.