Jasper was thrilled—his cousins were finally approved to adopt their new daughter, and he fully intended to deliver some exciting congratulatory gifts. He’d already climbed the corporate ladder pretty nicely so far, blazing his way to a tax preparer role at Deloitte, but he was hungry for more.

The issue was his obsolete job application . . . how could he write a resume that would reflect his understanding of the industry’s current state while spotlighting his unique qualifications?

Jasper’s confidence grew once he clicked on our library of resume examples, and his momentum carried him through creating a cover letter, too. Those gifts for his new family member were soon to be on the way—alongside a rewarding step in his career, too.

Find your own success by looking through our tax preparer resume examples and other helpful resources like Jasper did!

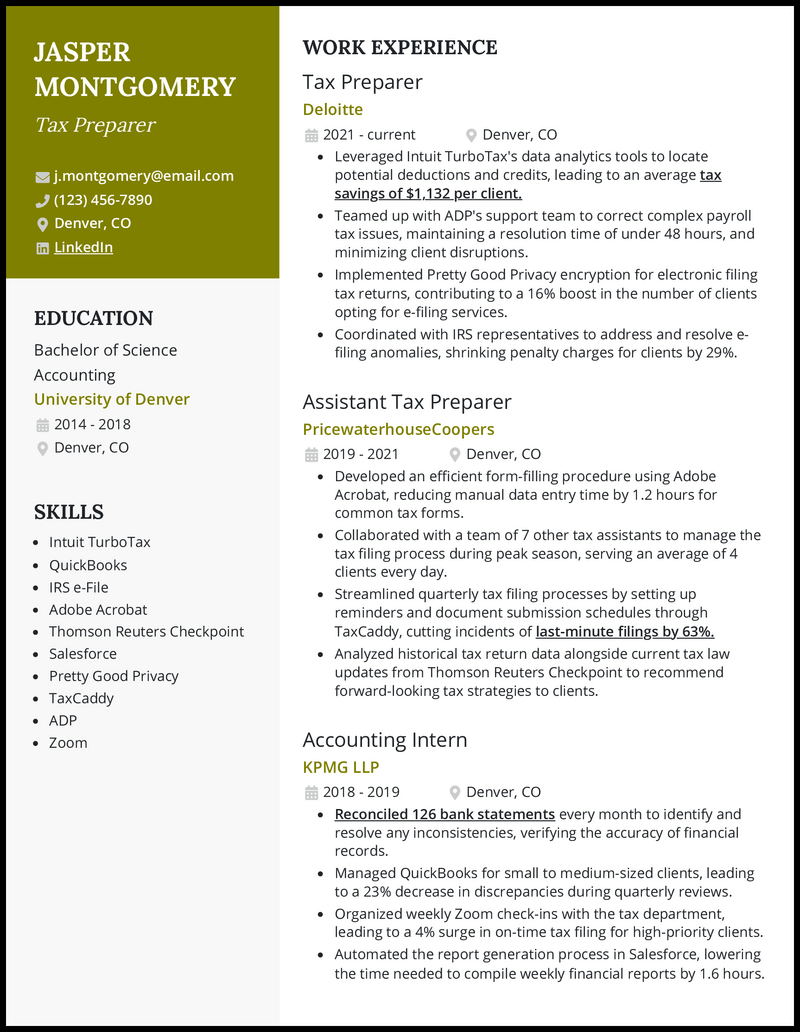

Why this resume works

- A bachelor’s degree is your ticket to landing this tax job. Whether it be a bachelor’s or even a master’s, state what level of degree you hold in accounting.

- The next step is to show resolve in your tax preparer resume. Add any internship experience that you managed to get during the same year of graduation. If it’s for accounting, in particular, highlight your knowledge of the subject by mentioning how you handled hundreds of bank statements accurately.

Why this resume works

- What do you use for preparing tax returns for clients that are compliant with the latest regulations? Don’t let your in-demand skills in tax software go unnoticed here!

- For your tax associate resume, clearly list down all the software you use for tax returns such as H&R Block Tax Software. You can further add more depth by including extra tools like CCH Axcess Tax that help users prepare industry-compliant tax returns. Lastly, mention the tools you use for keeping records such as Excel or Google Sheets.

Why this resume works

- As a manager, you’re directly responsible for ensuring that clients are happy with your company’s tax services. This can include accurate tax returns or even query resolutions.

- Put your managerial skills on display here by using quantifiable work experience such as “improving the client satisfaction rate by 36% as per feedback” to prove your ability to keep clients happy. You can also add similar bullet points that show your contribution to reducing response times in your tax manager resume.

Why this resume works

- If you’re specifically good at something when it comes to tax, then don’t hesitate to mention it in the career objective of your tax intern resume.

- For instance, how do you stay abreast of the latest tax trends? By adding the necessary skills and tools you leveraged to not just be updated but also understand any changes in tax policies.

Why this resume works

- It’s completely fine if you don’t have a direct education qualification such as an accounting degree for this role. Prove your worth through past project experiences here.

- Have a special ability such as an eye for detail? Add it in! Show your expertise in paying attention by using metrics where you were able to identify profitable tax benefits that others missed out on. You can also make use of other metrics in your entry level tax preparer resume that highlight your critical thinking skills.

Related resume examples

Adapt Your Tax Preparer Resume to Tick All the Boxes

Your role as a tax preparer demands a unique set of skills, and you know better than anyone what those skills are. Since this is a technical role, it’s totally fine to get into the nitty-gritty. Impress hiring managers by emphasizing your proficiency in tax codes, IRS regulations, and the latest accounting software.

Detail your knack for uncovering deductions, managing audits, and ensuring precision in financial documentation. To make sure you truly stand out, it’s essential to tailor your resume to each application, mirroring the skills mentioned in the job description.

If the company needs an auditing pro, highlight your auditing skills, or if it needs impeccable documentation, emphasize your dedication to thorough record keeping.

Need a few ideas?

15 top tax preparer skills

- Tax Code Proficiency

- QuickBooks

- IRS Regulations

- TurboTax

- Audit Management

- Xero

- Data Analysis

- Microsoft Excel

- Tax Research

- Data Security

- TaxWise E-Filing

- Zoho Books

- Bloomberg Tax

- Slack

- Tax1099

Your tax preparer work experience bullet points

From navigating intricate tax codes to orchestrating flawless financial audits, successfully completing a job as a tax preparer is no small feat. Hiring managers know this, so there’s no better way to impress them than by highlighting your greatest successes and happiest clients.

Showcase achievements like optimizing client deductions, ensuring accuracy in tax returns, or even streamlining the audit process.

Then, to seal the deal, add specific numbers and percentages that make it clear just how successful you were—after all, you didn’t just ensure accuracy, but you reduced errors by 78%.

- Show off your attention to detail by talking about the percentage of error-free tax returns you’ve consistently delivered.

- Highlight client satisfaction with metrics like feedback surveys, customer retention, or return customers.

- Showcase the percentage of successful audits managed without major discrepancies to show that you’re no stranger to keeping everything in order.

- Specify the average time taken to complete and file tax returns to express that you’re not just on point, but you’re also quick.

See what we mean?

- Managed a portfolio of 71 clients, delivering tax planning and advisory services that led to an average of 16% cut in tax liabilities

- Leveraged Wolters Kluwer CCH’s electronic filing feature, resulting in a $107 reduction in paper filing costs and a 92% e-filing rate

- Maintained a ledger of 546 client accounts within Zoho Books, reducing outstanding receivables by 29% with regular follow-ups and collections efforts

- Coordinated with IRS representatives to address and resolve e-filing anomalies, shrinking penalty charges for clients by 29%

9 active verbs to start your tax preparer work experience bullet points

- Optimized

- Implemented

- Ensured

- Collaborated

- Managed

- Maximized

- Facilitated

- Streamlined

- Advised

3 Tips for Writing a Tax Preparer Resume as a Beginner

- Show off your academic prowess

- Academic achievements demonstrate your dedication to mastering tax-related concepts. As such, if you excelled in classes like Tax Accounting or Advanced Financial Reporting, make sure to mention them alongside your GPA and any extra coursework.

- Mention personal projects and internships

- If you’ve worked on tax-related projects on your own time or gained experience through internships, highlight this. Describe how you applied your knowledge in practical scenarios, whether it’s optimizing deductions for a mock client or assisting in tax audits.

- Add a career objective

- Craft a clear and concise career objective that reflects your passion for the job. Show off your desire to apply your knowledge in a practical setting and emphasize your commitment to accuracy, compliance, and client satisfaction.

3 Tips for Writing a Tax Preparer Resume as a Seasoned Professional

- Show off extra certifications

- Showcase memberships to organizations like the National Association of Tax Professionals (NATP) or relevant certifications you hold, such as the IRS Annual Filing Season Program (AFSP) or Certified Financial Planner (CFP). These validate both your skills and your passion for the industry.

- Emphasize your client relationships

- Show that you’re an effective communicator with some well-placed work experience bullet points. Whether it’s resolving complex tax inquiries or providing proactive tax planning advice, emphasize that you were able to build long-lasting client relationships.

- Highlight continuous development

- Mention any tax-related seminars you go to, workshops you take part in, or conferences you attend to emphasize your dedication to the field and commitment to staying on top of your game.

ATS scans for relevant terms (such as IRS, audits, QuickBooks, etc) so align your skills and experiences with those in the job description. Using a clean and professional resume format without flashy graphics also helps the software read your resume effectively.

Absolutely! Always quantify your achievements, whether it’s the accuracy rate in tax returns, client satisfaction scores, or successful audit rates. These kinds of numbers add substance to your accomplishments.

Tax preparation is about clarity and accuracy, so use a resume template with a format that clearly presents your contact information, career summary, skills, work experience, and education. This makes sure that hiring managers can quickly see your qualifications and assess your suitability for the role.