Claims Adjuster

Best for senior and mid-level candidates

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

When someone files for an insurance claim, it’s not uncommon for them to be experiencing a stressful moment. That’s why helpful pros like you are needed to inspect properties, provide swift reviews, and ensure great client service.

Is your resume providing the evidence needed to land your ideal job?

In the detail-oriented insurance industry, displaying a lock-tight set of professional skills on your resume is vital to stand out. We’re here to help with our claims adjuster resume examples that worked for many insurance professionals in 2026.

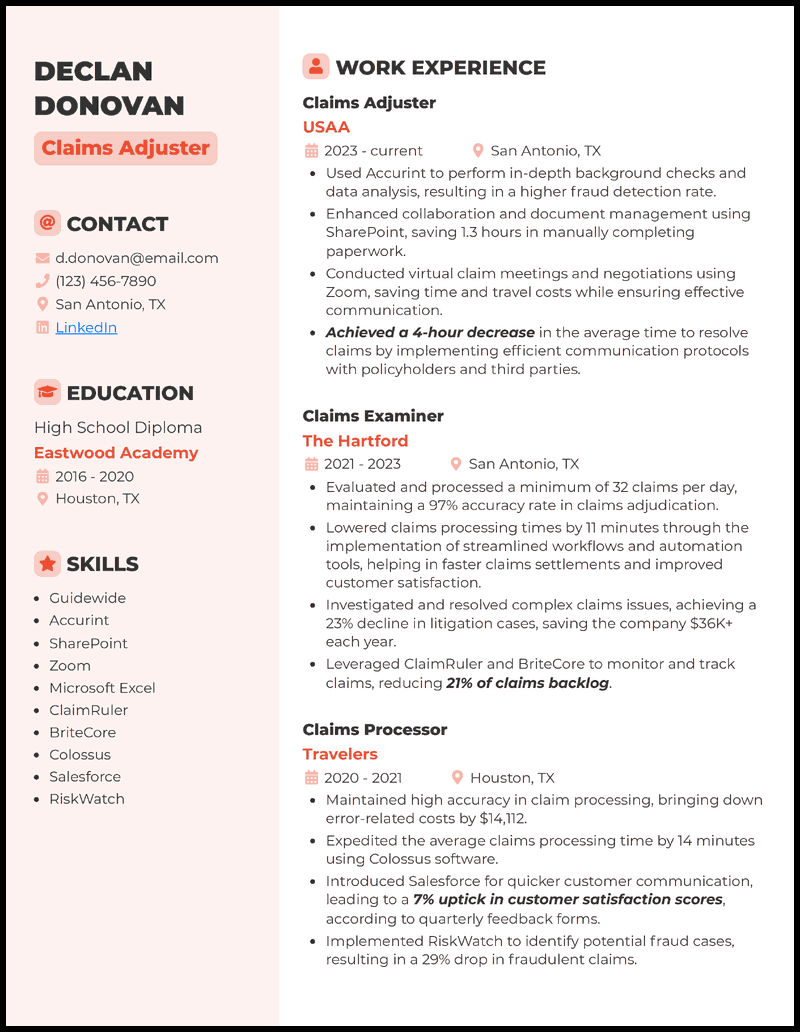

Why this resume works

- You may not possess the advantage of being a college graduate, but you still have a great chance to clinch this job. One thing that every employer is interested in are the skills that you possess.

- Including a section for skills in your claims adjuster resume is a terrific idea. However, you must show how you applied such competencies to support customer service, save time, and streamline communication.

Why this resume works

- It’s understandable to have some jitters when applying for your first real job. For one, you don’t have a lot of experience to support your entry level claims adjuster resume.

- But hold on. Do you have some personal or coursework projects relevant to the job you’re applying for? Great. Leverage the achievements from such projects and paint a picture of a hard and smart worker.

Why this resume works

- Dealing with insurance plans can be challenging since no one knows what the emergencies of policyholders is going to be like tomorrow.

- However, if you can show that you’re a candidate who handles such pressurizing tasks while maintaining a high satisfaction rate, you’ll create an irresistible senior claims adjuster resume. Craft smart bullet points like “Managed catastrophic event claims with a high claimant satisfaction rate” to be on every employer’s selection list.

Why this resume works

- Did you know you can beat many opponents by ensuring your claims adjuster trainee resume gets to the right person? All you have to do is write it for the applicant tracking system (ATS) that most hiring companies now use to sift through applications.

- Calista, for example, uses a simple, two-column layout, bullet lists for their work history, and an easy-to-read font. The fact that they don’t add an image of themselves is a nice touch, too, since the ATS detests graphics.

Why this resume works

- If your experienced claims adjuster resume gives recruiters the slightest hint that you know the ropes, they will be captivated. But when you want to take their breath away, show them your career journey using the reverse chronological format.

- Torin, for example, kicks things off by highlighting their wins as the lead claims adjuster at Farmers Insurance (current role) and then proceeds to the stint they had before that as a junior claims adjuster and the one before that as a trainee, throwing their growth-oriented mindset in the limelight.

Why this resume works

- Are you willing to go the extra mile and write that job-winning claims adjuster team lead resume that will turn the tides in your favor? Let your leadership prowess shine in your sales pitch.

- To showcase their ability to be in the driver’s seat, Lucian capitalizes on power words such as managed, trained, and spearheaded and emphasizes their accomplishments as team lead at State Farm Insurance.

Why this resume works

- Chances are, the recruiter received hundreds of applications, and they could be bone-tired by the time they get to lay eyes on your field property claims adjuster resume. Let’s translate that: They might not even read yours! However, bolding a few phrases to draw attention to your accomplishments can pique their interest in you.

- How about we use Evander’s resume as an example? It’s impossible to miss bolded phrases like “…cutting annual repair cost disputes by $38,846”, even at first glance. What’s more, they beg you to read every word of their sales pitch and get a better grasp of the value they can bring, right?

Why this resume works

- Whether your independent claims adjuster resume earns you a face-to-face with the hiring manager boils down to one thing—relevance. That’s why you can’t let tailoring your pitch to the open role slip through the cracks.

- But how do you customize your piece, you ask? It’s easy: Review the job posting and show you’re a natural fit because you have the skills and experiences the potential employer seeks. Isolde, for instance, puts their proficiency in job-relevant tools like Xactimate and Symbility (which could be a requirement) under the spotlight.

Why this resume works

- You can get almost everything right in your medical claims adjuster resume, and a seemingly small oversight will kick you out of the job race. A good example? Failing to proofread your piece so it’s riddled with glaring grammatical mistakes when the recruiter sets eyes on it.

- Take it from us: your resume must be as flawless as Malachai’s unless you want to convey that you’re reckless or inattentive to detail. The fix? Reread it several times and get the most out of spell checkers (read Grammarly) to eliminate typos, punctuation errors, and awkward phrases.

Why this resume works

- The hiring manager won’t pick anyone to fill that open role—if you don’t look like the crème de la crème, they will turn their back on you. How about showing them you make the grade by adding metrics to your casualty claims adjuster resume?

- Believe it or not, a phrase like “…identifying $451K in potentially fraudulent claims within the first quarter” is all it takes to get the recruiter sold on your value. Why? It shows what you did in your previous role and helps you break the mold since many other applicants might not even quantify outcomes in their resumes.

Why this resume works

- A public adjuster resume with many irrelevant details is a deal-breaker in the potential employer’s book. Rowena’s masterpiece is perhaps one of the best examples we can give.

- So, they don’t fill the hiring manager in on personal information like their race, marital status, nationality, sexual orientation, spiritual beliefs, and health status or history. Instead, they play it safe by only adding relevant resume components (read the header, work history, educational background, competencies, and contact info), which also helps to put together a neat piece that is easy on the eyes.

Why this resume works

- Not every claims adjuster can manage to oversee commercial insurance policies due to their intricate nature. So draw out past roles that speak volumes about your expertise in the field and watch your commercial claims adjuster resume find a favorite spot among recruiters.

- Ever worked as a claims specialist or processor? Add them. Including such roles with quantified metrics gives hiring managers a solid idea of how you’ve built your career in the field so well.

Why this resume works

- What’s one career highlight that you’re proud of and you’ve replicated in every position and company you’ve ever worked for?

- Well, for Teddy, it’s reducing cost per claim and in the end, saving employers thousands of dollars in payout. Whatever consistent achievement it is for you, mention it boldly in your auto claims adjuster resume and let recruiters know the kind of impact you can make at the workplace.

Why this resume works

- One thing that many job applicants get wrong is choosing a resume format that is too casual and not easy for hiring managers to read.

- Avoid that mistake by choosing a professional resume template for your insurance claims adjuster resume. Create a balance between the text and white spaces and separate each section. Your application will be unstoppable!

Why this resume works

- The property industry is a fast-paced environment and can get messy at times. To be excellent at what you do here, you need both experience and a proper understanding of the sector.

- Therefore, a property claims adjuster resume with a solid inclusion of software and tools, and the competent use of such to keep all stakeholders satisfied is a big plus for you. Spare not any skill that you think will put you ahead of other applicants.

Why this resume works

- Sure, your educational background and skills carry a lot of weight. But when it’s time for recruiters to figure out whether you fit the bill, they’re definitely looking beyond that. They’ll also pay attention to your ability to hit the mark, making calling attention to quantified results in your bodily injury claims adjuster resume a must-do.

- Mull over bolding, italicizing, or underlining a remarkable outcome per job entry. For instance, notice how “producing detailed and accurate repair estimates for over $1.2 million in damages across 53 cases in Q2” and “…streamlining the management of 61 active claims for a total payout of $842,064” steal the spotlight, showcasing Ambrose’s knack for spot-on outcomes.

Why this resume works

- So, you’re at the top of the game. But here’s the kicker: the recruiter seems out of the loop. Now, given that the fate of your career is in their hands, kick off your catastrophe claim adjuster resume with a bang by bringing your experience (and wins) in a similar role to light.

- For instance, recount how you evaluated claim outcomes using job-relevant software like FRISS, maybe preventing 11 fraudulent claims and saving the company $56K. And who could forget that other time you overhauled internal claim processing workflows with Xactimate, facilitating a solid 18% drop in damage estimation errors? If such don’t scream a game changer, we don’t know what does.

Tailor Your Claims Adjuster Resume to the Job Description

While applying to different companies, it’s essential to consider what types of insurance they offer and their specific claims processes so you can tailor your resume to specific needs.

Reviewing the job description will help you stand out in that aspect. Whether you’ll be managing medical or business claims, you can ensure you list a custom set of skills that stands out.

Need some ideas?

15 best claims adjuster skills

- Damage Assessments

- Loss Valuations

- ClaimRuler

- Customer Service

- Litigation

- Xactimate

- Police Reports

- Medical Reports

- Liability Assessments

- Westlaw

- Claims Xpress

- Negotiation

- Underwriting

- Axonwave

- RiskWise

Your claims adjuster work experience bullet points

As a claims adjuster, your ability to provide accurate assessments and thorough customer service is crucial.

A great way to make your abilities stand out on your resume is by including the right metrics and examples, such as how you boosted data accuracy or client retention.

Here are some excellent metrics to include on your claims adjuster resume.

- Fraud detection rates: An insurance company’s success depends on an accurate claims assessment, so showcasing your ability to detect fraud will stand out.

- Reporting efficiency: The faster you can process and review reports, the more satisfied clients will be with your services.

- Cost reductions: Whenever you can reduce costs in reporting, assessments, or settlements while still getting great results, it’ll showcase a lot of skill to insurance companies.

- Compliance rates: The insurance industry is highly regulated, so boosting compliance with policies is crucial.

See what we mean?

- Maintained a customer satisfaction rate of 98% by providing exceptional service and timely updates to policyholders.

- Cut average claims processing time by 36 hours through the implementation of streamlined workflows and efficient use of technology, including Zoom meetings for virtual inspections.

- Proficiently used Xactimate to create accurate property damage estimates, resulting in an average reduction of 13% in claims settlements.

- Implemented Matterport 3D technology to assess property damages, resulting in a 33% improvement in accuracy and a 48-hour reduction in claims processing time.

9 active verbs to start your claims adjuster work experience bullet points

- Integrated

- Leveraged

- Managed

- Applied

- Assessed

- Reduced

- Resolved

- Achieved

- Enhanced

3 Tips for Writing a Claims Adjuster Resume if You Lack Experience

- Emphasize transferable skills

- Many jobs in other industries can translate to being a great claims adjuster. For example, you could explain how you improved problem resolution rates as a customer service rep or boosted accuracy as a data entry clerk.

- Include non-traditional work experience

- Non-traditional work, like volunteering or projects, can help you stand out as an entry-level claims adjuster. For example, volunteering for your local Habitat for Humanity performing home repairs could showcase transferable abilities to provide damage assessments on the job.

- Use an objective

- A resume objective will help you emphasize your career goals and a couple of top job skills that can make you stand out immediately. For instance, you could write a few sentences on how you’re eager to apply your three years of data management experience to ensure accurate claims filing.

3 Tips to Write an Expert Level Claims Adjuster Resume When You Have Experience

- Use reverse chronological order

- As you’ve grown in your career, your abilities in Xactimate and reviewing medical or police reports have likely improved quite a bit. Therefore, listing your most recent experiences first will ensure your most relevant abilities stand out.

- Eliminate irrelevant jobs

- When you have a lot of experience, some of your previous jobs can be eliminated from your resume, such as when you worked as a data entry clerk or claims assistant. Aim to list three or four jobs that are the most recent and use a relevant skill set, such as loss valuations and negotiation.

- Include measurable impacts

- Insurance jobs are always results-oriented. Including numbers for every example you list will ensure your impact stands out, such as how you improved filing times or increased reporting accuracy.

A one-page resume is the optimal length. It should provide a concise overview of skills and experiences that are highly relevant to each claims adjuster job. For example, a business insurance company may appreciate you emphasizing your abilities in liability assessments and loss valuations. Anything you need to expand on can be left for when you write a cover letter.

As a claims adjuster, you’ll be expected to take action and get the most accurate results during coverage assessments. Action words like “processed” and “reviewed” help emphasize the impact you had. For example, saying you “processed 156 medical claims with 99% accuracy” sounds more impactful than saying you “know how to perform medical claim processing.”

A resume summary works well when you have ten or more years of experience in the insurance industry. For example, you could explain how you’ve performed over 200 accident claim assessments and thoroughly reviewed police reports to ensure 97% accuracy in identifying fraudulent claims during your 11-year career.