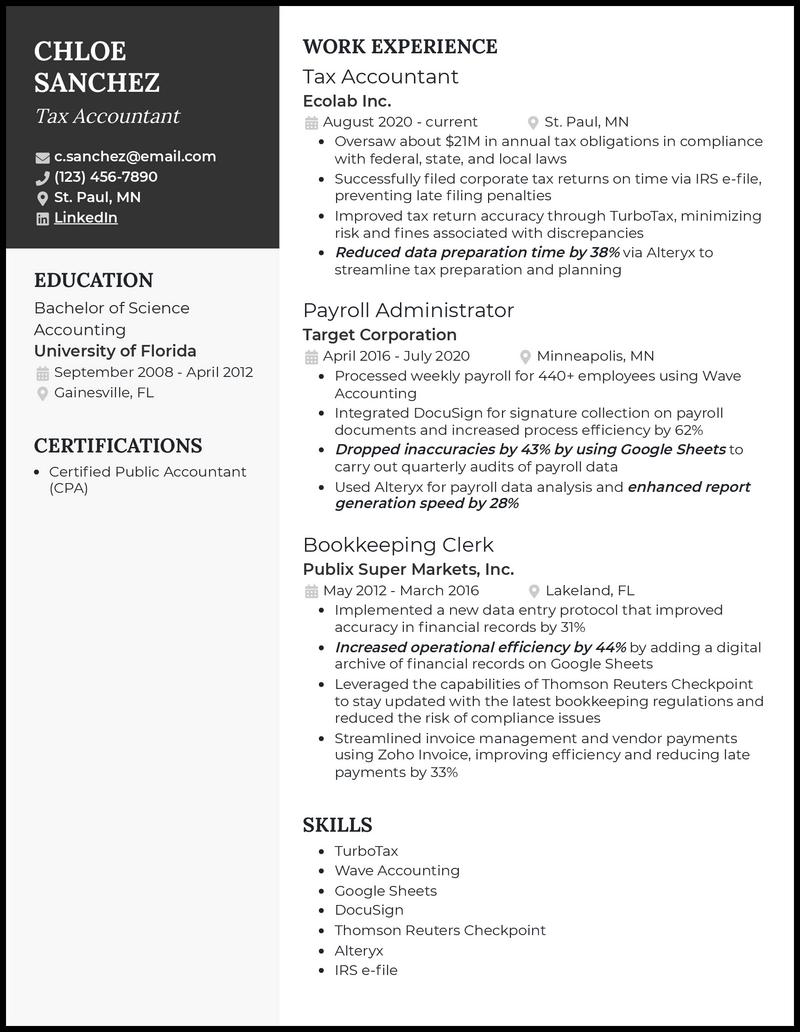

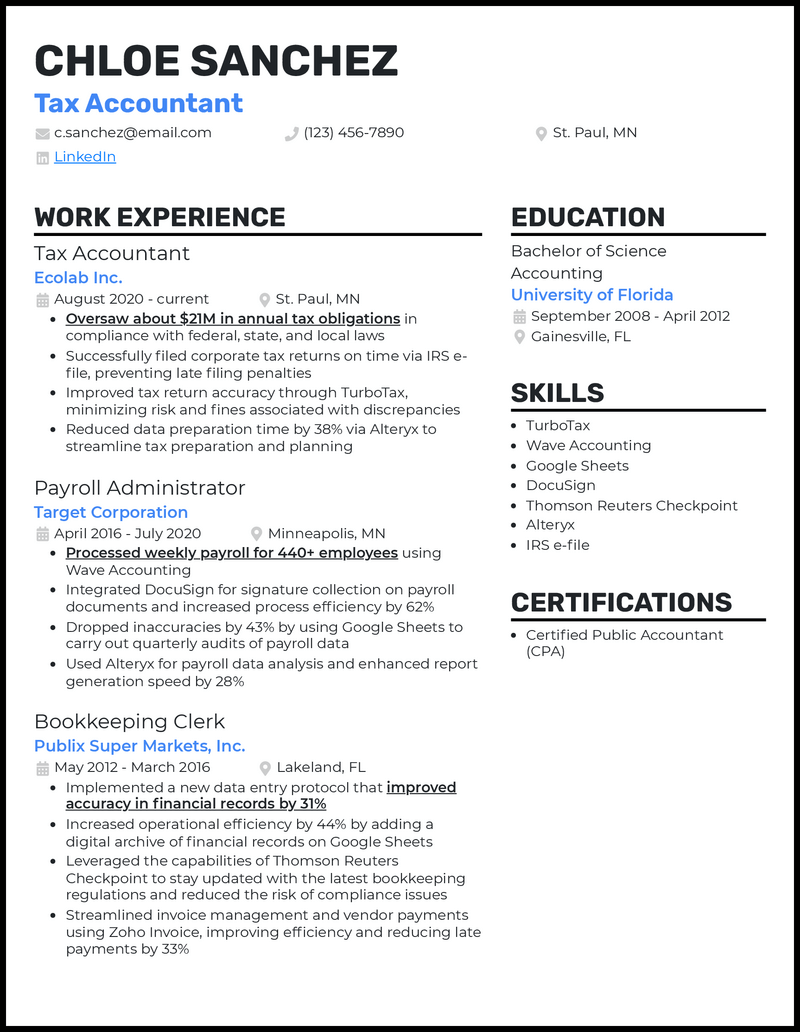

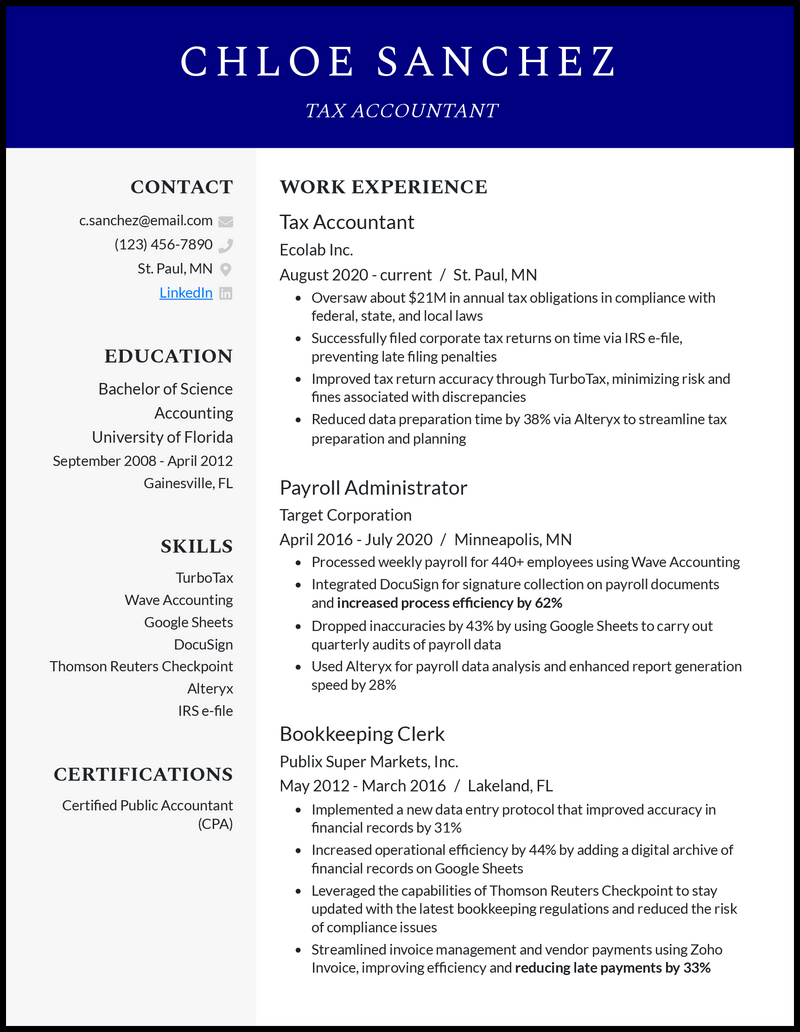

You’re passionate about helping clients responsibly file taxes while maximizing returns. You provide detailed financial reviews, friendly service, and effective filing strategies to help clients maximize their results in the process.

Does your resume template help maximize your potential to help you land your next job?

Tax accounting is a very results-driven field where accounting firms and corporations will review applications comprehensively to ensure they choose the right candidates. We have your back in the process with our AI cover letter generator and tax accountant resume examples that have proven to be successful in 2026.

Related resume examples

What Matters Most: Your Tax Accountant Skills & Work Experience

Tax accountants need a well-versed skill set in everything from tax laws to optimizing cash flow strategies. So, where do you start when filling out the skills on your tax accounting resume?

Just like you would review each client’s financial information to give them tailored advice, you want to analyze the job description and pick out skills that fit each company’s primary needs. For instance, an accounting firm that works with business owners may be interested in your corporate tax planning and payroll analysis abilities.

Here are some of the best tax accounting skills employers are looking for in today’s job market.

9 best tax accountant skills

- GAAP

- Tax Planning

- Cash Flow Analysis

- Microsoft Office

- Quickbooks

- Accounts Payable

- Accounts Receivable

- Income Statements

- Sarbanes-Oxley Act

Sample tax accountant work experience bullet points

Tax accounting is data-driven, so employers will always want to see the results you’ve achieved through past work experience.

Ideally, you want to include metrics with each example you provide, such as how you improved filing efficiency or returns generated.

Also, keep your examples short and simple, just like you would when outlining complex filing details to clients in a way that’s easy to understand.

Here are a few samples:

- Performed risk management analysis on quarterly company financial reports to reduce compliance issues by 45%.

- Maintained consistent relationships with clients, answering any questions and performing detailed research into filing issues to boost satisfaction scores by 56%.

- Prepared property and income taxes for individuals, ensuring all relevant deductions were made to boost returns generated by 36%.

- Reviewed income statements for corporate clients, identifying 7 areas that helped reduce tax bills by 23%.

Top 5 Tips for Your Tax Accountant Resume

- Limit your resume to one page

- Keeping your resume concise and relevant to each job is important, so limiting it to one page is a great way to optimize it. For instance, a consumer-based accounting firm would be most concerned with your individual property and occupational tax management skills.

- Use reverse chronological formatting

- Tax laws continuously evolve, along with software like Quickbooks for managing financial information. Therefore, listing your most recent experience first helps emphasize skills that are most relevant to current tax accounting needs.

- Proofread thoroughly

- Just as miscalculating deductions wouldn’t get your client the best results, a resume full of grammatical errors won’t help you succeed in the hiring process. Show you can perform accurately right away by proofreading for errors before submitting.

- Optimize with action words

- Every client you work with will expect you to take action when filing their returns, so optimizing with action words like “prepared” or “researched” is a great idea. For instance, you could say you “prepared over 300 tax returns for clients each year, doing thorough reviews to ensure a 99% approval rate upon submission.”

- Keep it organized

- Clear headers, bullet points with tax accounting achievements, and an easily readable 12-14 point font are great ways to organize your tax accounting resume for easy review. It’s the same as how you’d want to outline important filing information so clients can make easy decisions.

Limit your resume to three or four previous jobs. Keep the jobs you list to the most recent ones and those that use the most relevant skills to tax accounting, like cash flow analysis or ensuring compliance with the Sarbanes-Oxley Act.

Your cover letter should connect with the company’s mission and fill in any gaps about how your tax accounting skills fit in. For instance, you could write about how you want to use your tax planning skills to help the accounting firm achieve its goal of a stress-free end-of-year filing experience.

A resume summary will benefit tax accountants with ten or more years of experience. It could include information about how you’ve managed a portfolio of $1.9 million in client accounts, ensuring details were always prepared ahead of time for 99% on-time filing over your 11-year career.