Maybe some people would be intimidated by the idea of incorporating key skills and qualifying examples of their potential as a financial advisor—but not Matt. He was too determined to increase his budget for that new car that would finally replace his old clunker!

After some research on how to present himself as an invaluable hire, he found our stockpile of top-notch financial advisor resume examples. Eager to create a stellar application package, Matt took cover letter writing next, preparing to make the most of his translatable soft skills and stellar financial metrics. His gusto paid off, and soon he was driving to work in style.

If you’d like advice on how to write a resume, keep on reading so that you can crunch your own numbers and find success like Matt.

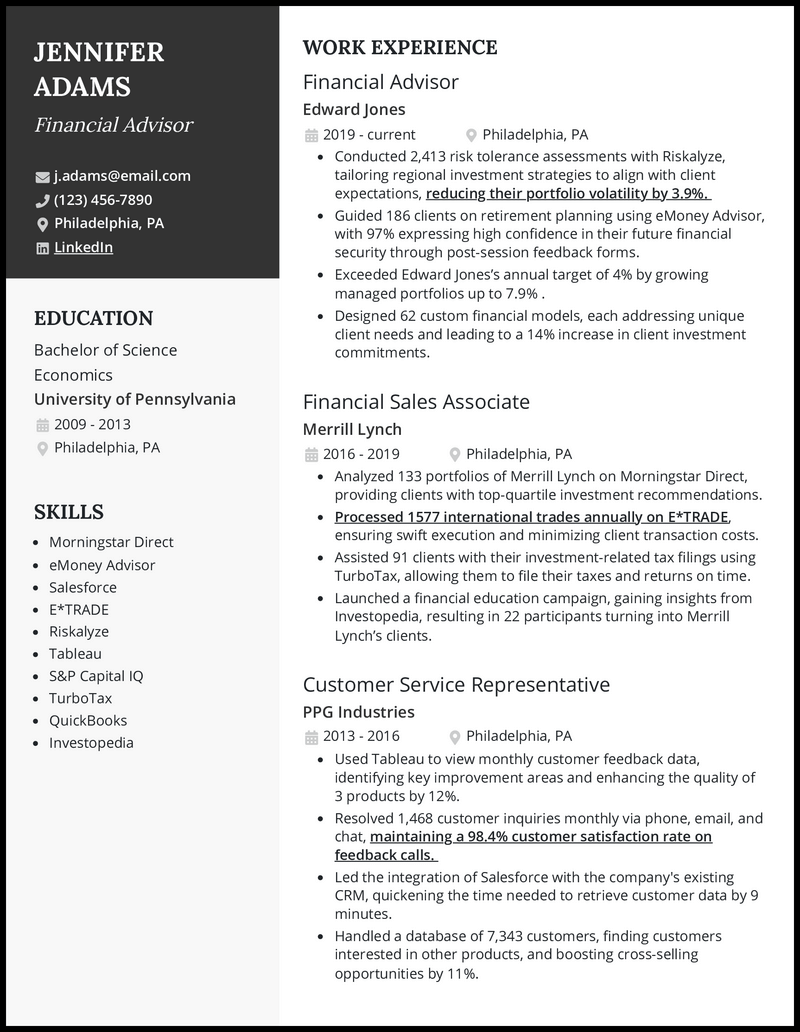

Why this resume works

- Not every financial advisor needs to have a special certificate or master’s in finance to prove their worth. Even if you only have an economics degree, add it in to show your knowledge in that field.

- Your financial advisor resume doesn’t need to start with a finance job either. A customer service representative will work just fine as long as you show your contribution to improving customer satisfaction. Remember to mention how you’ve made regional and international trades to highlight your expertise in understanding global economics and trade.

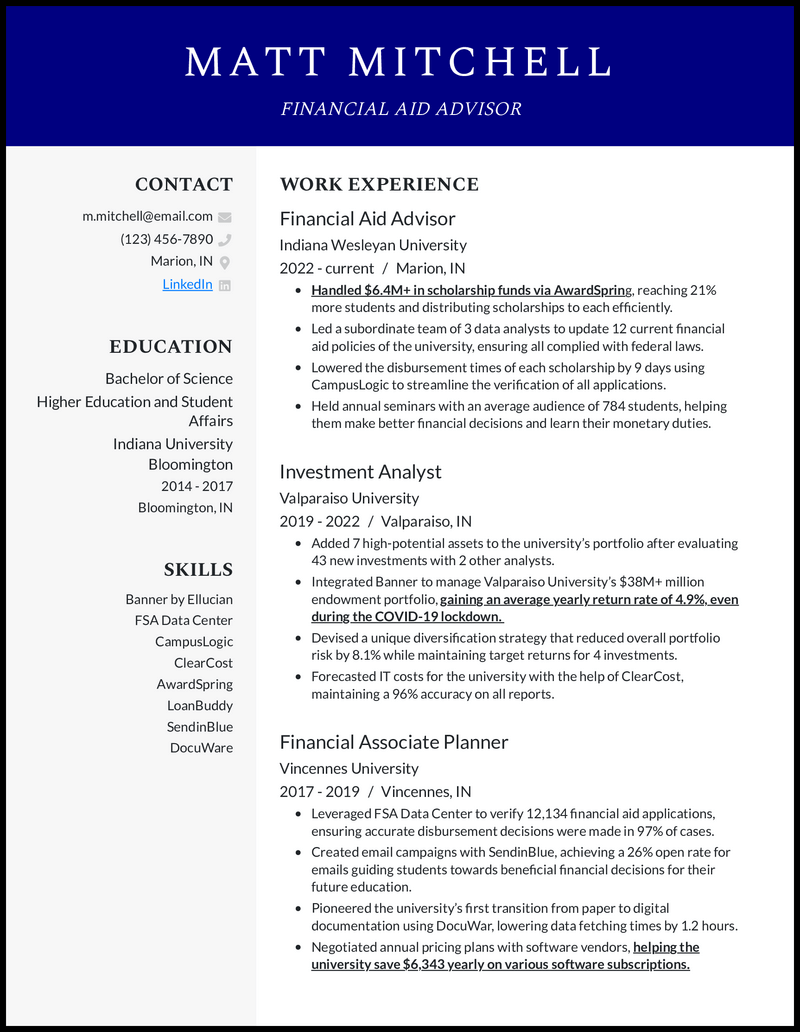

Why this resume works

- The best way to make your financial aid advisor resume a treat for your potential employer is to add past quantified financial experience in different universities.

- Handling funds in an investment company can differ vastly from a university, hence, ensure that you state every aspect of not just providing returns on a portfolio or disbursing scholarship funds, but also guiding students in general for their future education.

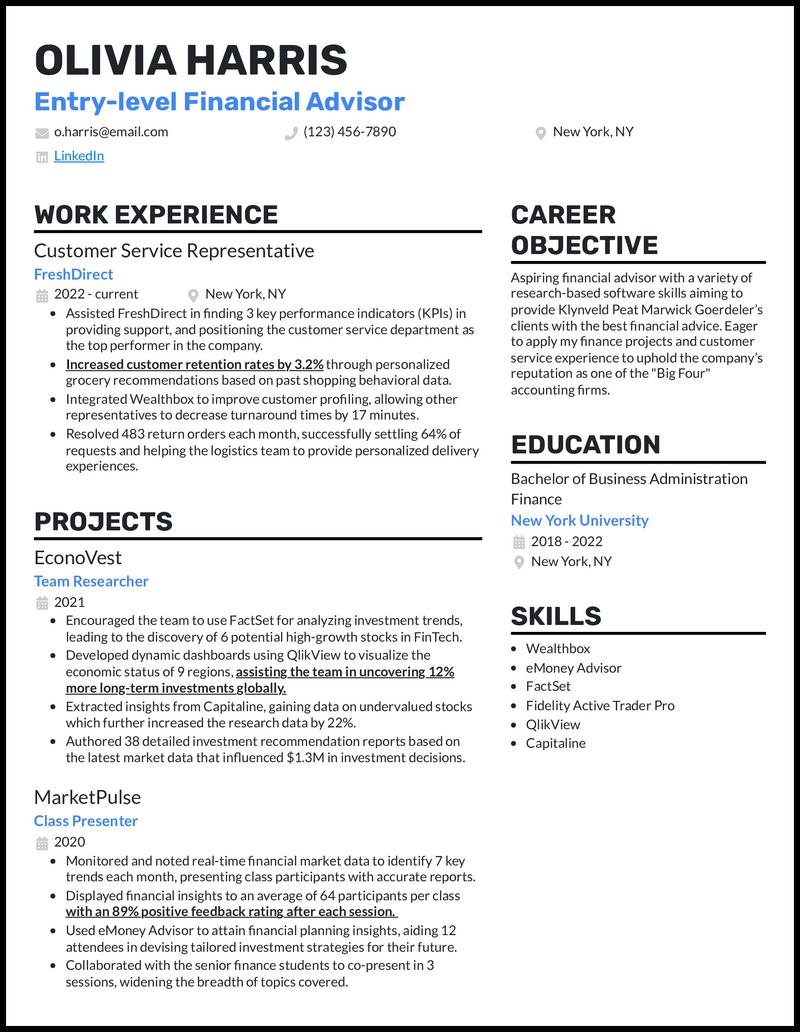

Why this resume works

- It feels nerve-racking, doesn’t it? Sending your first-ever entry-level financial advisor resume to an established accounting firm such as Klynveld Peat Marwick Goerdeler. To prove yourself better than the average entry-level applicant, you’re going to need project experience. The more, the merrier.

- Even if it’s only as a presenter or researcher, mention how you’ve used skills like FactSet and eMoney Advisor to gain financial insights and help others make investment strategies. Finish things off with an actual work experience where you’ve interacted with customers in any way.

Related resume examples

Tailor Your Financial Advisor Resume for Each Job’s Description

If you were planning an investment strategy for a client, you’d want to understand their current and future financial needs to achieve the right goals. You’ll also want to account for each company’s specific needs while writing your resume.

Start by reviewing the job description to identify the qualifications each company is seeking. Is a company trying to improve its pricing strategy? Then, your abilities in market analysis and forecasting will be important to emphasize. Take a similar tailored approach to each resume you submit.

Need some ideas?

15 best financial advisor skills

- Risk Management

- Pricing Strategies

- QuickBooks

- Forecasting

- Market Analysis

- Morningstar Direct

- Portfolio Management

- Financial Modeling

- Tableau

- E*TRADE

- Investopedia

- Retirement Planning

- Asset Management

- Client Relations

- Equity Analysis

Your financial advisor work experience bullet points

When a business or client puts their money in your hands, they’ll want to know you’ll achieve positive results.

The best way for financial advisors to optimize for success is by including actionable bullet points describing previous work achievements. Each example should be backed by a number, such as how you boosted ROI, to showcase the exact impact you had.

Here are some excellent metrics for financial advisors to use.

- Portfolio growth: One of the most significant signs of success for advisors is growing client portfolios with optimal investments and management year over year.

- Portfolio volatility: The more you reduce risk, the better chance companies or clients will want to work with you.

- Report accuracy: The data you gather during market analysis is crucial to making informed monetary decisions, so showcasing accuracy is always a great idea.

- Client retention: It’s unlikely clients stay with a financial advisor who isn’t getting them great results, so showcasing how you create a great experience for them will stand out.

See what we mean?

- Conducted 2,413 risk tolerance assessments with Riskalyze, tailoring regional investment strategies to align with client expectations, reducing portfolio volatility by 3.9%.

- Designed 62 custom financial models, each addressing unique client needs and leading to a 14% increase in client investment commitments.

- Forecasted IT costs for the university with the help of Clear Cost, maintaining a 96% accuracy on all reports.

- Integrated Wealthbox to improve customer profiling, allowing other representatives to decrease turnaround times by 17 minutes.

9 active verbs to start your financial advisor work experience bullet points

- Planned

- Optimized

- Oversaw

- Assisted

- Increased

- Resolved

- Forecasted

- Negotiated

- Analyzed

3 Tips to Write an Impactful Financial Advisor Resume Without Much Experience

- Lean on educational achievements

- While completing an economics, finance, or related degree, you likely achieved much that contributed to your skill set. Therefore, listing achievements like how you used Tableau to reach 65% more effective conclusions during a financial forecasting project will help you stand out.

- Include transferable skills

- Even if you haven’t worked in a financial advisory role, other jobs will still have transferable skills. For example, you could write about the cash handling and accurate account management skills you gained as a bank teller.

- List hobbies/interests

- Your hobbies & interests can also show relevant abilities for inexperienced financial advisors. For example, you could write about how you volunteered for a homeless shelter for two years and optimized spending to provide more blankets and beds for those in need.

3 Tips to Bolster Your Financial Advisor Resume When You’re Experienced

- Keep examples short and relevant

- You’re probably very passionate about what your financial work accomplishes. However, keeping these examples to relevant one-sentence descriptions is still important to allow hiring managers to easily pick up on your key financial modeling and analysis skills.

- Use reverse chronological formatting

- Financial processes are always being updated with new GAAP standards and changes in the market. Therefore, listing your most recent experiences first is essential to showcase how you optimize for compliance and portfolio growth based on today’s needs.

- Use an organized template

- It can be easy to have your resume get disorganized when you have a lot of portfolio and asset management experience. Using a well-spaced resume template with clear headers and an easily readable 12-14 point font will ensure your top achievements, like decreasing investment risks by 32%, grab attention.

Think of your resume like you’re presenting a few key market indicators to supervisors after analysis. To make decisions easy, you’ll want to limit your resume to three or four jobs that are most recent and relevant to your current risk analysis and asset management skills.

A resume objective works well when you don’t have much financial advisory experience. For example, you could write about how you’ll apply your two years of experience as a data entry associate to ensure client portfolio data is managed accurately.

Aim to connect your cover letter to the company’s mission and how your top financial advisory skills fit in. For example, while applying to a retirement planning firm, you could write about how you have a deep passion for using your investment planning and wealth management skills to help others achieve a healthy and happy financial future.