Accounts Payable

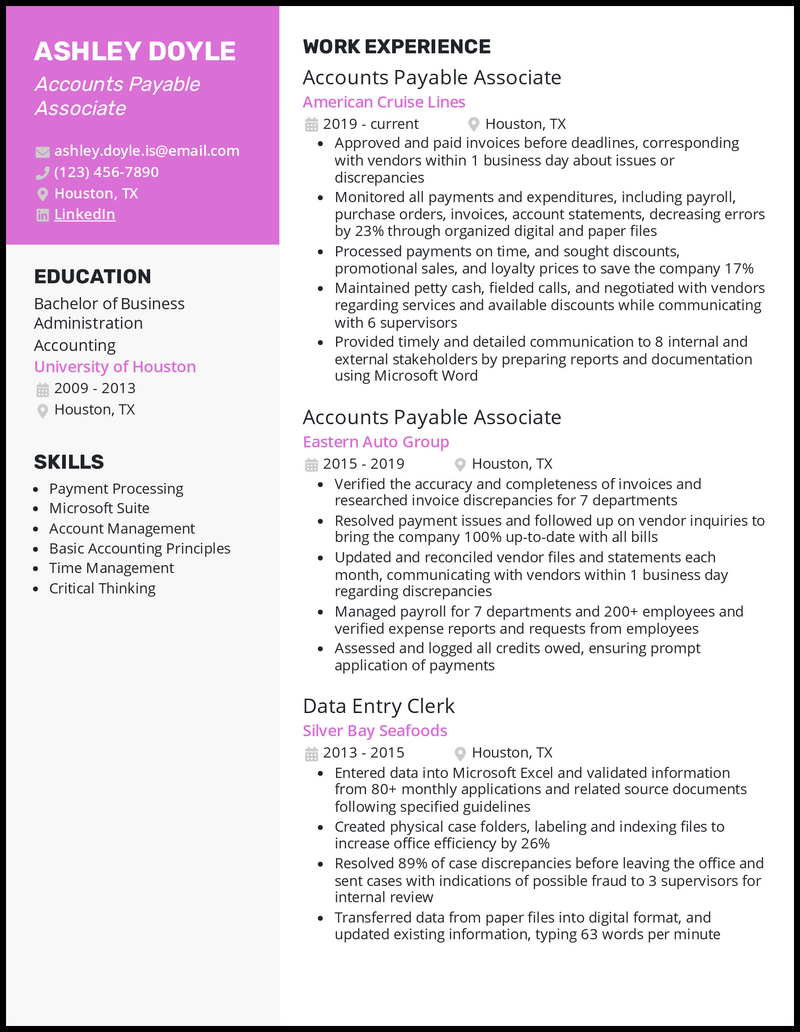

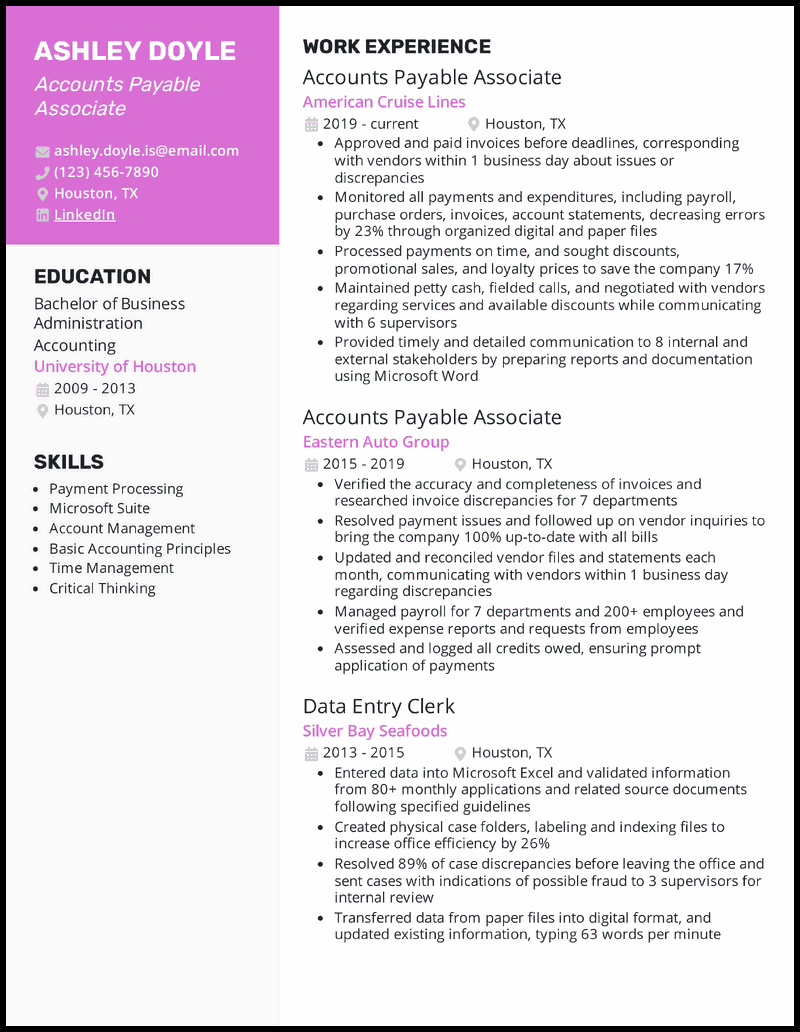

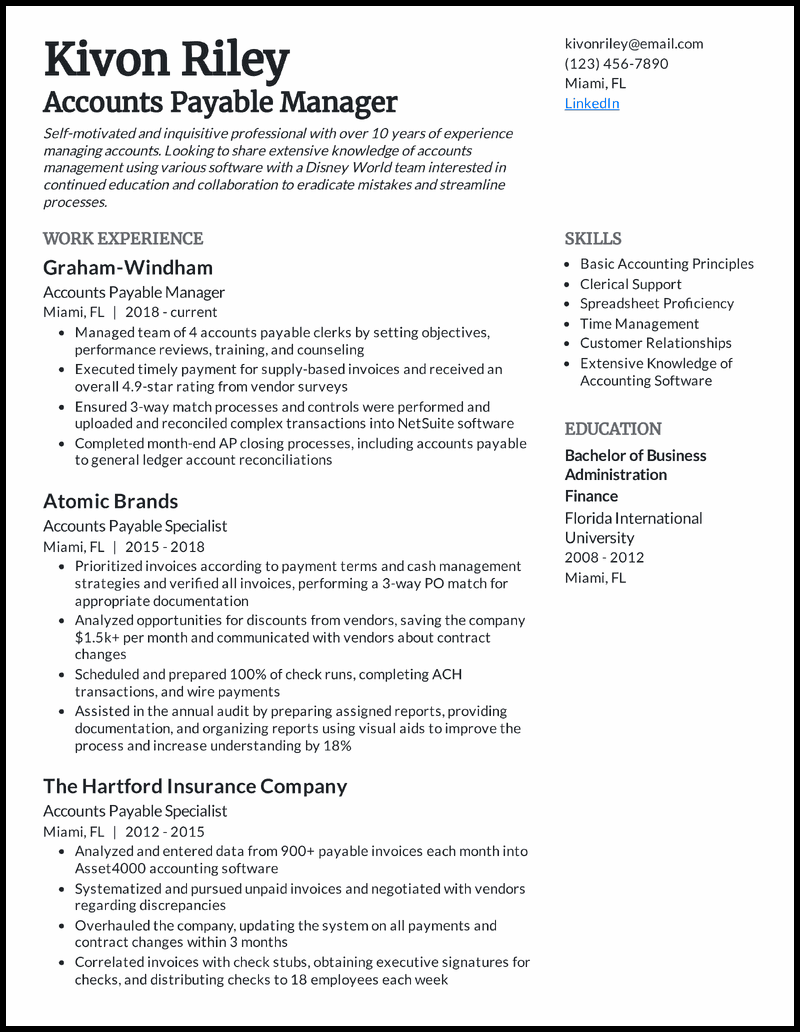

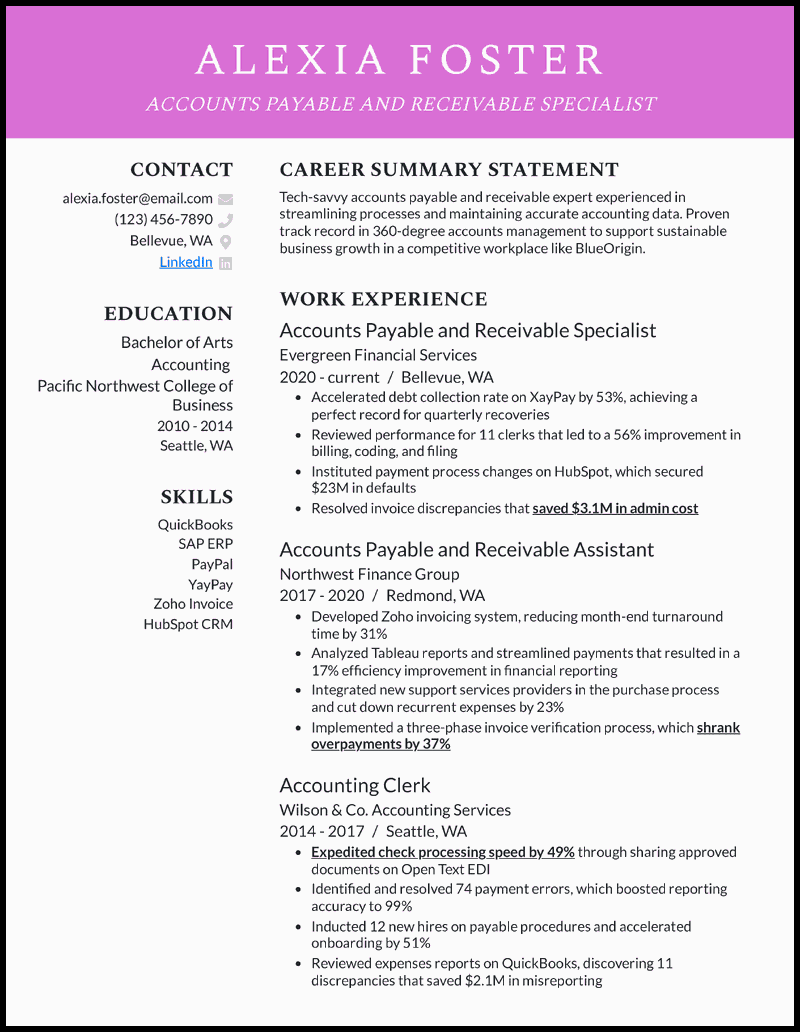

Best for senior and mid-level candidates

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

Writing an accounts payable resume is your chance to show how you keep finances accurate, deadlines met, and vendors satisfied through a focused resume writing process.

Back it up with a cover letter that connects your skills to the company’s needs and leaves a strong first impression.

Here’s what we’ll cover:

- ↪ 9 Accounts payable resume examples to spark ideas and guide your writing

- ↪ Key resume tips to present your experience with clarity and impact

- ↪ How to create a polished, professional layout that reflects the value you bring to the business

Outsmart the ATS system

- Imagine spending hours creating a great accounts payable resume, only to have it rejected within seconds because of the ATS system.

- Choose fonts that are easy to read and check the job responsibilities to pick out keywords like “experience in P2P cycle” or “strong understanding of month-end close activities.”

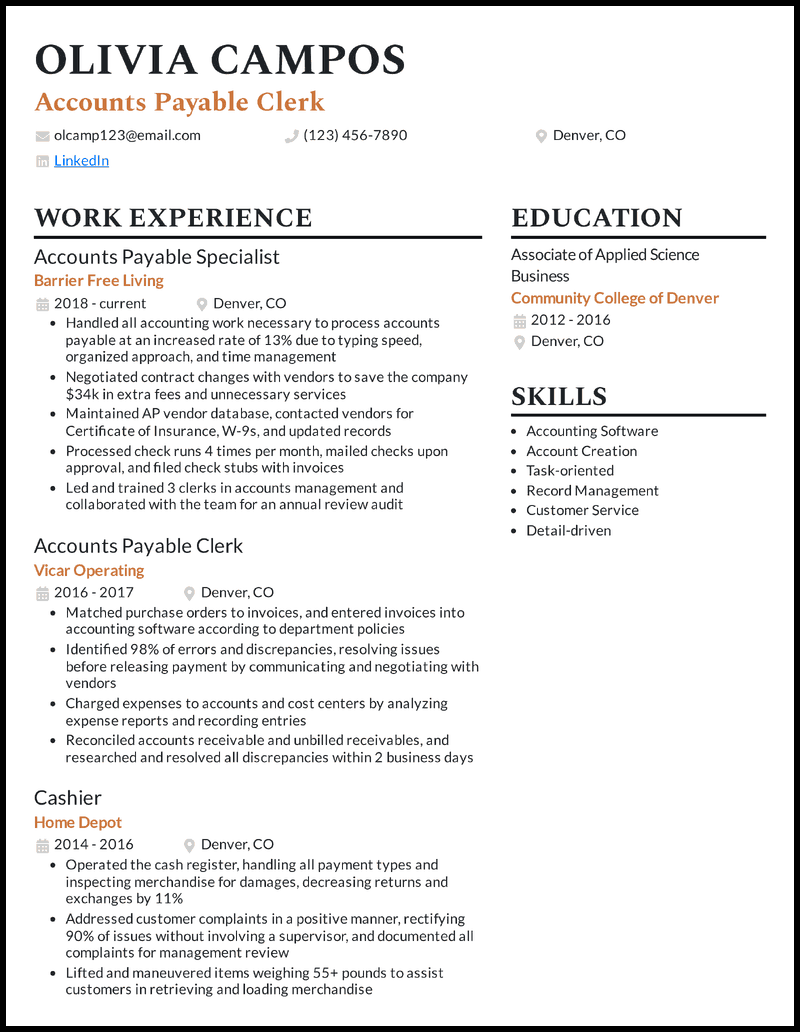

Discuss your growth

- Don’t hesitate to add previous entry-level roles and how you’ve climbed the ranks in your accounts payable specialist resume.

- For instance, write how you handled transactions during peak hours with high accuracy and show your early commitment to managing finance for companies.

Build the education section

- A bachelor’s in finance or accounting will work best for your accounts payable manager resume. Without that, then an associate degree in accounting might be enough.

- Next, check your resume and if you’ve got some extra space to work with, include any relevant coursework like financial accounting, accounting systems, and internal auditing.

Leverage skills

- Visit the job description for a discovery expedition. If they need someone who can handle finance data on spreadsheets then including Microsoft Excel or Google Sheets are good addition to your accounts payable and receivable resume.

- See more accounts payable and receivable resumes >

Summarize your career

- For candidates with 10+ years of experience in handling accounts payable tasks, using a career summary comes quite handy for the perfect accounts payable clerk resume.

- Highlight your career’s signature moments like successfully reducing late payment cases for companies, streamlining the invoicing process, or even helping firms maintain high audit scores.

Quantify your impact

- The best way to prove your skills in your accounts payable supervisor resume is to show the kind of impact your previous input had on companies. So, try to create as many quantified work experience bullet points as you can.

Stick to a one-pager

- To make a strong impact, create a short, yet meaningful accounts payable analyst resume that gets their attention.

- Try making use of resume templates to design a one-page resume that helps you show employers your best accounting job achievements.

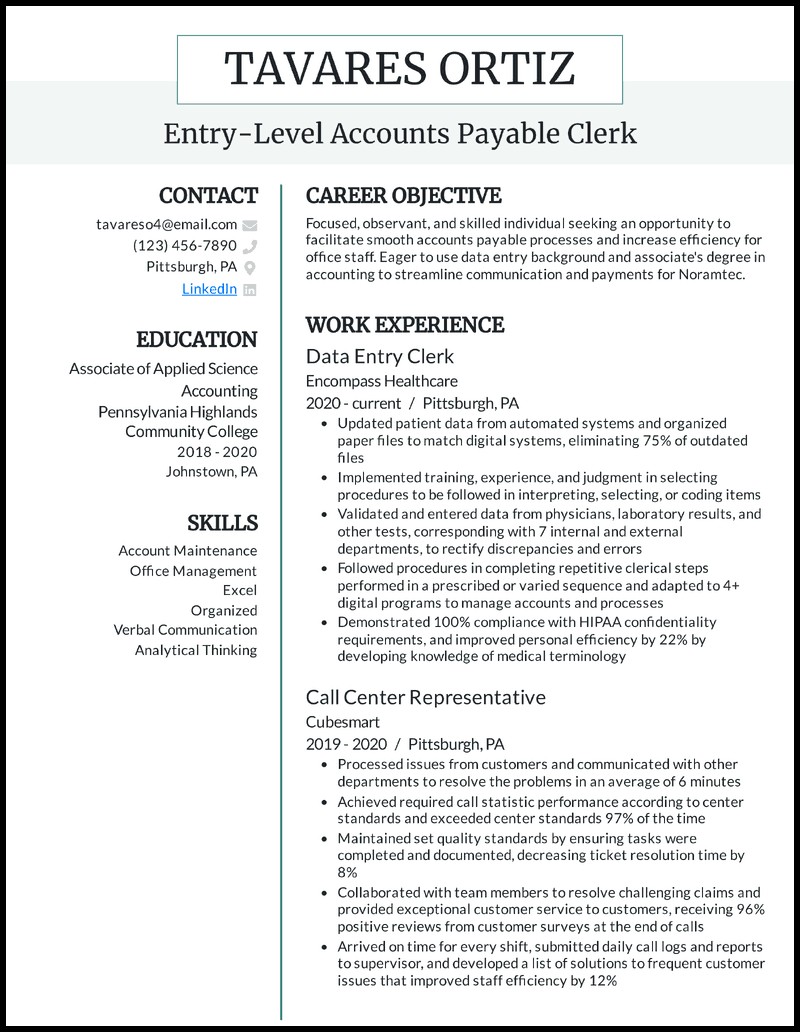

Add projects for experience

- For an entry-level accounts payable resume, using a smart format to include past projects is the best way to prove your eye for detail in finance.

- Try projects that show your ability to streamline communication, keep any data-related discrepancies at a minimum, and ensure high accuracy in maintaining records.

Tailoring your resume

- One of the best ways to take your accounts payable adminstrator resume up a notch is to include everything that the job description requires.

- What does the company need? Are they looking for someone who can review and reconcile invoice discrepancies? Maintain multiple vendor accounts? Or complete accounts payable-related data entry tasks?

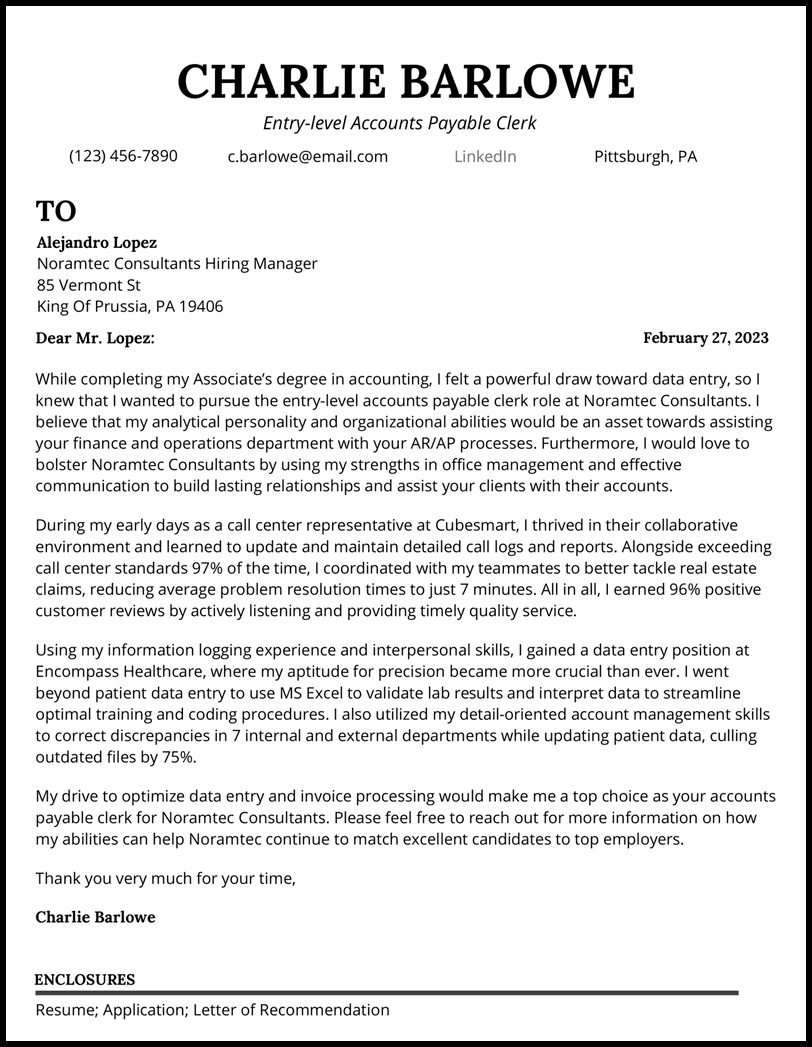

Missing an Accounts Payable Cover Letter?

Your accounts payable resume is finished (or close to being finished), but don’t hit “submit” just yet! You still need an accounts payable cover letter to complete your application. We make it easy with our editable cover letter templates—give it a whirl!

Why this cover letter works

- People love reading a good story, and that holds true for your accounts payable cover letter, too! Guide the reader through your most intriguing work experiences, highlighting details that demonstrate you as the ideal hire.

- Remember not just to share your own personal history–tell the story of how your journey has prepared you to help the company shine.

Related resume guides

How to Write an Accounts Payable Resume

Your accounts payable resume isn’t a list of your past roles; it’s a financial statement that tells hiring managers you know your craft.

Summary

Elevate your job hunt with an accounts payable resume that strategically highlights your financial accuracy, efficiency, and impact—crafted to outshine the competition and impress hiring managers instantly.

Your job requires precision, accountability, and staying organized, and you won’t force your way in if all you have to show are buzzwords. Like the error-free invoices you produce, your resume must reflect attention to detail.

Here we discuss:

- Clear summary that highlights your strengths in accuracy and organization

- Proven achievements with measurable results

- Key technical skills like accounting software proficiency

- Relevant work experience tailored to the role

- Education and certifications that support your expertise

It doesn’t matter if this is your first entry job or a position to climb the ladder to management; you must define the value you bring to the potential employer in areas such as fiscal compliance, revenue stabilization, and nurturing supplier relations.

Don’t follow what every other cookie-cutter resume does; show your domination in keeping clean financial records and running processes smoothly.

Ready to write a resume that recruiters will read more than once because you’re the dream candidate for the role? Let us show you what to do, plus get inspiration from these resume examples.

Key components of an accounts payable resume

Here’s a checklist of non-negotiable components for a standout accounts payable resume:

- Professional Header – Your name, title, and contact info

- Profile Section – An overview of your strengths

- Impactful, measurable, relevant work experience

- Technical and soft skills

- Relevant, recent education and certifications

- Bonus Sections – Projects, volunteer work, or professional memberships that reinforce your qualifications

Understand your responsibilities first

Don’t be in a hurry to get started. First, know what the role expects of you. Review, once again, the job ad with a keen focus on responsibilities. You’ll notice that the employer isn’t interested in someone to take care of bills, but a versatile, resourceful pro who can:

- Reconcile accounts with pinpoint accuracy

- Verifie invoices

- Negotiate terms with favorable business outcomes

- Keep a clean account of records

- Collaborate with cross-functional teams, such as those from finance and procurement

- Adhere to accounting principles

- Ensure regulatory compliance

Command attention with the right layout

You’re in finance and probably know that a flawed financial system is the fastest way to sink a business. The same goes for a messy resume; no recruiter would want you near their finances.

For the right resume format, stick with reverse chronological order. It’s what applicant tracking systems (ATS) can easily screen and what hiring managers prefer. Place your most recent and relevant role at the top of your work experience section. Go backwards to older jobs, ensuring that you only include information that adds value to the position you’re seeking.

Use bold and bigger font sizes for headers and a different color from the rest of the text. Please don’t use too much color, as it may draw attention away from your strengths.

Be consistent with the use of margins, white spaces, and font types and sizes. Any element you use must be appealing, but be careful that it doesn’t detract from your professionalism.

Craft a professional resume header

How you begin your resume matters. A well-crafted header says you’re organized and ready to keep books clean and accounts compliant.

Include:

- Professional names

- Your title

- Email address (no room for aliases and nicknames)

- Active and current phone number

- LinkedIn profile (if relevant)

- Location (nothing personal)

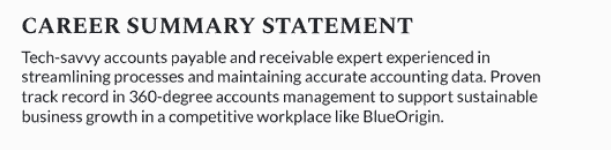

Hook recruiters with a compelling profile summary

Typically, a hiring manager will spend a few seconds reviewing your resume. You can’t gamble with such a short window. This is where a professional summary can make a significant positive difference by saying who you are, what you can do, and the value you bring.

Depending on your experience, you can write a career objective or a resume summary. An objective works best for beginners and career switchers. Conversely, a summary is an excellent asset for experienced professionals with an impressive work history and outstanding accomplishments.

One way to ensure that a professional summary is impactful is to align it to the role. Whatever the prospective employer has on the job posting is exactly what they want to see in a suitable candidate.

Example of a career statement for an accounts payable and receivable resume

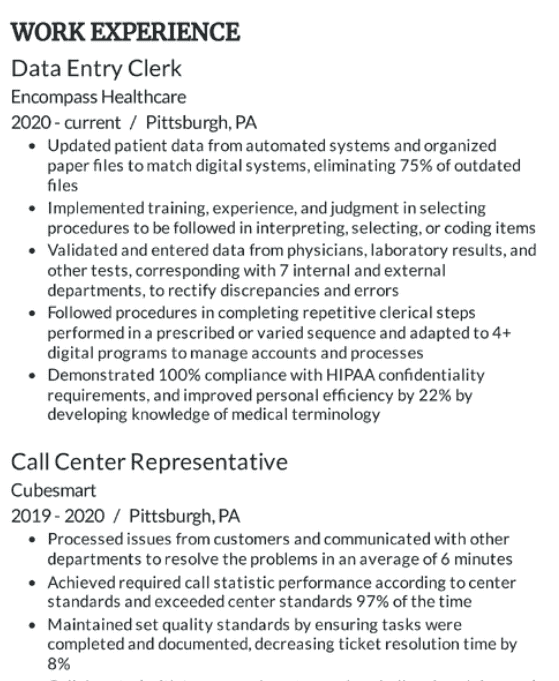

Bring your relevant work experience to the forefront

Your work experience section is the battlefield that determines your fitness for the job. It reflects your career history, drawing parallels to what the new role entails. Here, you must be selective and bring only relevant experiences from your past.

You should indicate the role’s title, company, time, and location of every entry. Most importantly, accompany each role with 3-4 impactful bullet points. These should begin with compelling action verbs tied to skills, and metrics to highlight your impact.

For the metrics, use a blend of numbers, percentages, dollar amounts, time, frequencies, and ratings. One caution, though: Be realistic and do not be tempted to blow your achievements out of proportion. If caught lying, you’ll be left with an egg on your face and out of the race.

How to write an accounts payable resume with no experience

Everyone’s career starts somewhere. Embrace who you are and put on a confident face as you switch gears from school to the real job world.

Internships, volunteer work, projects, shadowing, and relevant coursework are part of your experience. All you have to do is highlight your contribution and the results of your direct input. These and transferable skills will convince recruiters of your potential to make an impact.

Another trick is bringing your education to the forefront and sealing the work experience gap. Relevant education means you have the theoretical foundation and need an opportunity to put what you’ve learned into practice.

Example of work experience for an entry-level accounts payable resume

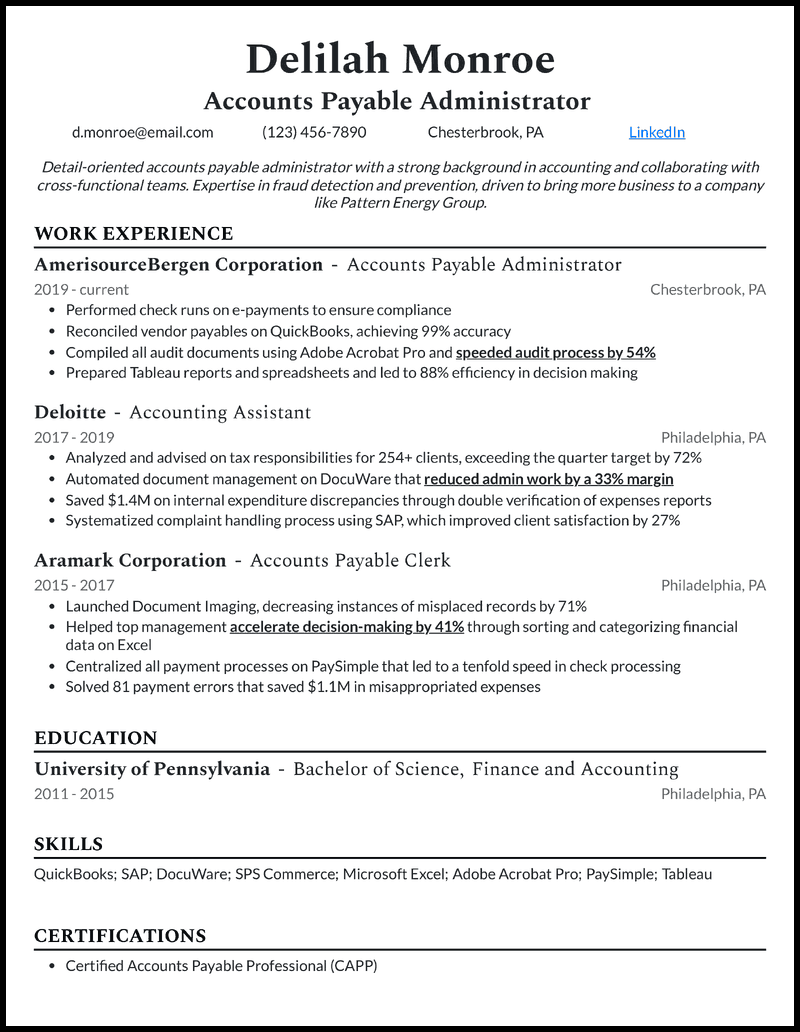

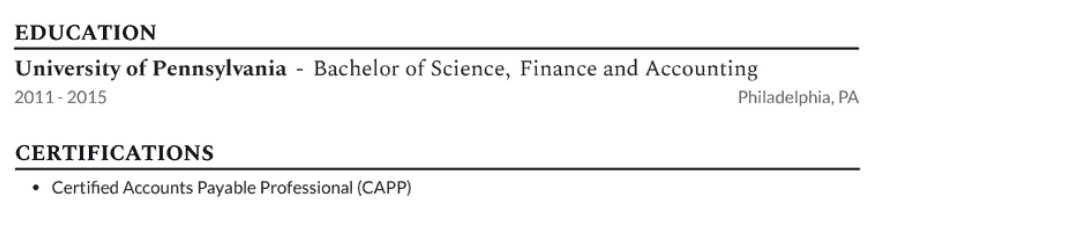

Include relevant education and certifications

Don’t have a finance or accounts degree? Don’t fret. If you can mention relevant coursework or practical projects, you’re as good as any other candidate.

Relevant education is a beacon of authority, indicating that you’re a professional who understands the principles and work ethics of the accounting field.

A proper education section should include:

- Field of study

- Institution’s name

- Date of graduation

- Location (often city and state)

- Coursework and GPA of 3.5 and above (relevant for new graduates)

Are you a certified accounts payable professional? Do you hold credentials for any other relevant program? These are your badges of credibility, and you wear them (rather include them in your resume) with honor.

Certifications prove your resilience, hunger to learn, and dedication to your career. If hired, you’re likely to work hard, grow, and keep up with the latest trends to benefit of your employer.

Prove your competencies

Let’s focus on the fuel that powers your resume by proving your abilities. Your skillset is one of the best-selling points of your potential. They say to employers, “Hey, look at my technical proficiencies and soft skills; they’re exactly what you’re looking for.”

The key to ensuring your skills count is aligning them with the checklist the recruiter provides in the job description. Repeated phrases, tools, and keywords hint at what ATS and recruiters will be paying attention to when they scan your resume.

As much as this is a technical profession, you can never ignore your soft skills. Therefore, on top of hard competencies, throw in some good interpersonal attributes that show you’re a complete professional.

Don’t just create a section and list your skills; deploy them in your work experience bullet points. What is the use of any of them if you can prove you know how to use them?

Bonus sections: Projects, voluntary work, membership in professional bodies

You’re not the only one interested in the job. Also, you’ll face an equally or even more qualified competition. So, how do you set yourself apart and ensure you make a great impression on HR managers?

Adding extra and relevant sections can be your trump card in beating other competitors. Projects, voluntary work, and membership in relevant professional bodies such as the Institute of Finance & Management (IOFM) can give you the edge you need to earn an interview spot.

Key takeaways

Let’s do a round-up of what you’ve learned:

- Be specific and intentional on your resume

- Structure your resume right: Clear, professional format

- Back up your value with hard figures

- Even without experience, project and transferable skills are anchors of hope

- Certifications, professional memberships, and volunteer work make you stand out

Accounts Payable Resume FAQs

To write the perfect job descriptions for an accounts payable job, go back to the job posting and identify the keywords, skills, and duties. Those are the employers’ wishes; if you can make them come true, you’re getting hired. Build bullet points highlighting your work’s results and impact using those skills, keywords, action verbs, and metrics.

The perfect resume summary for an accounts payable specialist should mirror the employer’s views for a perfect candidate. Capture those expectations by using skills and other key phrases from the advert.

Example:

Senior accounts payable specialist with over 7 years of experience driving accuracy, compliance, and stakeholders’ satisfaction in fast-paced finance companies. Spearheaded payment system overhaul that reduced invoice processing time by 24 hours, saving over $120K annually in late fees and labor. Proficient in SAP, QuickBooks, and Excel automation. Committed to making accounts payable a strategic business asset.

Optimize your accounts payable resume by matching it to the job. This means using keywords, skills, metrics, active verbs, and reflecting the company’s tone. When ATS screens your resume, it’ll mark it as a perfect match and pass it to a human recruiter. With a document tailored to the job, you’ll land more interviews and boost your chances of getting hired.